I had a quote in a Reuters article regarding the earnings events in Facebook (and a little bit of Apple).

The situation is unusual, because investors are typically more concerned about downside risk and are willing to buy "disaster puts" - far out-of-the-money puts - at a higher relative price. This is because they do not want to lose a lot of money if the stock gets hit, said Steve Place, a founder of options analytics firm investingwithoptions.com in Austin, Texas.

You can read the rest of the article here.

I want to take some time and explain what exactly is going on in FB options, and how you can profit from it.

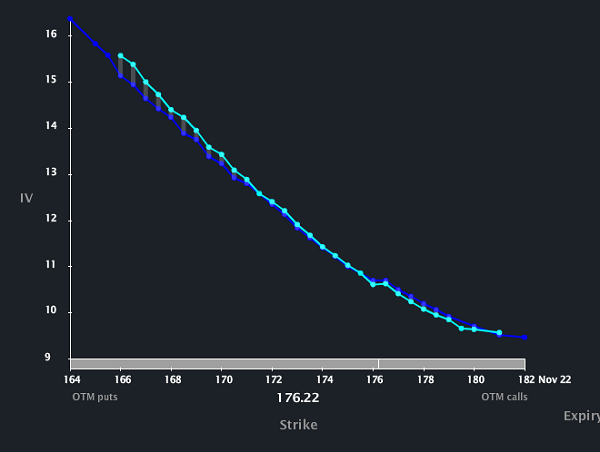

In a normal market environment, equity options will have an option skew-- this means that the implied volatility on lower strike puts will be higher than at the money puts.

So far so good.

When we deal with risk in the stock market, most investors care about downside risk.

Think about it, when have you ever heard of an investor cry because their stock gapped up 20%?

But there actually is something called upside risk, and it relates to opportunity cost.

If you're in cash and the stock you wanted to invest in gaps up 20%, then you missed out.

That is its own kind of fear. Fear of missing out.

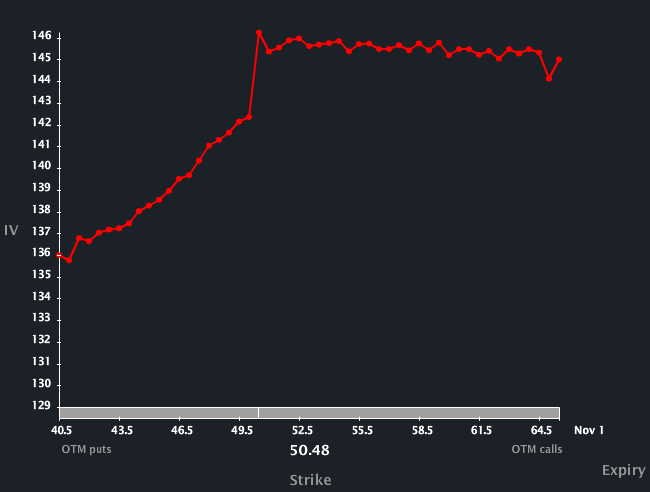

So FB options are seeing an inverted skew, which means out of the money calls have a higher implied volatility than ATM options. You can see this specifically on front week options.

There's a few reasons to account for this.

First, if you want to speculate on the upside of FB earnings, long stock may not be the best decision because that exposes you to a gap down. Many times we see investors just buy puts to hedge, but we're seeing a ton of calls being traded. That means traders are looking for more capital efficient methods (meaning they don't hold stock) looking for a binary outcome.

This also probably means that there's a bunch of speculators looking for massive upside in the stock. There have been a few examples of this recently, including the massive runup in YELP and TSLA where the skew got out of whack.

I think this is kind of silly, and you can smartly fade this.

So let's look at some ideas here.

If you already own FB and want to reduce your risk into earnings: buy a collar. Because of the inverted skew, a collar (buying puts and selling calls) is an attractive investment here.

If you already own FB and want to participate in more upside: sell a 1x2. This is an advanced trade that makes money if implied volatility drops and if the skew normalizes. If you sell far out enough, you can really make some good money on top of your FB holdings.

If you don't own FB and want to participate in more upside: buy call spreads. When you buy a call and sell a call that is further OTM, there are some slight benefits when the skew is weird like this. It also will be a more capital efficient play with less vega and theta risk compared to just buying calls outright.

Here's the thing-- I could be completely wrong, FB could smash numbers and we could see a move twice as much as what the options are pricing in. But the skew shows us that there is so much demand for that particular trade, it becomes difficult to play that with good risk reward-- so consider a slightly more complex strategy if you want to play FB earnings.

If you enjoyed this analysis, then you should become an IWO Premium member. Learn about how we trade