After the hype, the roadshow, the interviews, and the PR spin...

After the hype, the roadshow, the interviews, and the PR spin...

Facebook has finally gone public.

And while you think the newsflow would be going lower, tons of drama surrounding the entire IPO process continues to be in the spotlight.

Greed led the underwriters and the company to float more shares and raise the IPO price, only to see their strategy blow up in their faces. On top of that, market exchanges were hosed as the high frequency traders blew a circuit breaker stuffing orders while keeping retail traders out of the opening trades.

The bright side is: with volatility comes opportunity.

Next Tuesday, Facebook options will be listed and begin trading. Plenty of uncertainty surrounds the stock as the newsflow is still running hot around the company, and it is still in focus in non-financial media and is driving the overall zeitgeist of anyone with an internet connection.

Uncovering information about Facebook options trading is a very difficult task, as pricing risk requires plenty of extrapolation and educated guesses.

But looking through similar events may shed some light on how the options will trade over the next few months.

Can We Price the Risk?

The first thing to consider is how Facebook options will be priced next week. To do that, we will need a crash course in how the options market prices risk.

There are two components to an option value: intrinsic value and extrinsic value.

Intrinsic value is the relationship between the underlying stock price and the strike price of the option.

Intrinsic value is the relationship between the underlying stock price and the strike price of the option.

Extrinsic value is the price that is left over, and is what the market is willing to pay in order to exchange risk.

Remember this: the options market is a risk market, not a capital market. There is a cost to transfer risk, and it is derived from the extrinsic value of the option. It's also known as Implied Volatility.

Figuring out the Implied Volatility is a chicken and egg scenario-- that value won't be known until the market opens up, and there is some dark magic as to how the market makers will price the risk on the open.

The best solution is to use a "pricing analogy," where certain similar scenarios can give us a feel of where options should open up on trading.

Market Comparisons

The facebook IPO was full of hype, speculation, argument, and participation by non-financial players. It also served as a market validation of a major social media segment and had plenty of venture capital behind it.

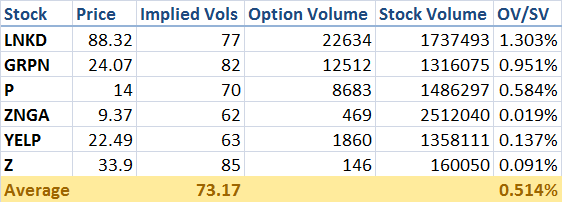

A few stocks come to mind here: $LNKD, $GRPN, $P, $ZNGA, $YELP, and $Z

From here we can look at the Implied Volatility readings from the day the options opened on each of these stocks. We can also view the options volume as a function of total stock volume to guess how many options would trade on the first day.

Using these past values as a guide, we can expect facebook options to have a 30-day implied volatility between 65 - 85. The mid 70's would be a good estimate.

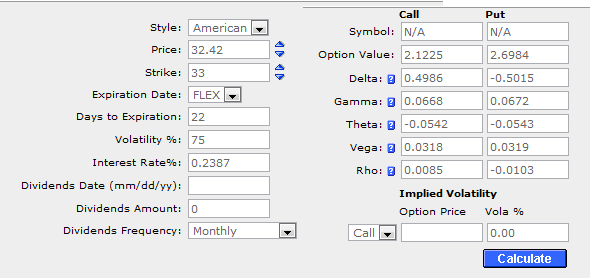

Now we can price out a hypothetical June option using an estimate of 75% implied volatility.

This calculator prices out a Jun 33 Call at 2.12 and the Jun 33 Put at 2.70. These prices are what we should expect for that option, assuming no errors in calculation and extrapolating similar events from the past.

How Will the Facebook Options Trade?

Knowing the hard math is only a small part of the equation. From here, we need to consider building out profiles of market participants to get an idea of how the options will trade:

Profile 1: The Bagholder

This is someone who owns shares from the trading price in the low 40s. Odds are they were in for a quick flip rather than an investment, and now they are hurting and in a significant drawdown.

If this participant is going to come into the options market, odds are they won't sell calls against their position. This would be akin to "locking in a loss," which is something that may be prudent but from a behavioral finance standpoint they won't take it. If anything, they will lock in their downside risk through put sales, which could provide an elevated implied volatility skew.

Profile 2: The Retail Gambler

This trader is most likely a retail trader with a smaller account who didn't trade facebook shares due to lack of capital. Instead, they will take advantage of the leveraged nature of the options market to be a net option buyer, looking for fast returns but in exchange for theta risk.

If facebook ever starts to see fast upside like we saw in AAPL a few months back, expect the volatility skew to turn into a smile, and for the implied volatility in the options market to rise when facebook rips higher-- this is a very rare occurrence in equity options, but it is possible.

Profile 3: The Market Maker

The MM will have a high expectation of trading volume-- rightly so.

FB is a story stock, with plenty of "arguments" on either side, very similar to AAPL or the action that occurred recently in TVIX. There is also newsflow that can affect the realized volatility of the market. The market maker may be hesitant to keep a tight market initially, but as days go on and competition for liquidity heats up, the bid/ask spread will continue to tighten up.

The introduction of weekly options will bring in the speculators looking for super-leverage, and high-frequency traders will step in to provide liquidity on the short term options.

Our Educated Guesses

We could build out a few more profiles but here's the general idea of what to expect:

1. Volatility skew will be steep. Investors and traders will be much more willing to pay up for disaster protection, which means implied volatility on out of the money puts will be at a higher level than at the money puts. There will most likely be an unwillingness to sell calls against positions, which means call volatility won't be pushed down.

2. High short term option volume. If recent history is any indication, liquidity will focus on the near term and weekly options, leaving those that want to take on longer term hedges in size with fewer exit options.

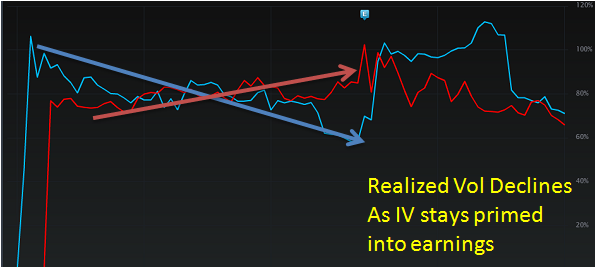

3. Implied Volatility will stay bid into earnings. This is an educated guess, but as newsflow dies down and the IPO trade comes off the table, the sentiment will shift towards the first earnings report and premiums will still run hot. This will be in the face of declining realized volatility as the day to day price action slowly grinds down. $LNKD is a good analogy of this:

Trades to Consider

Keep in mind that you are responsible for your own trading, you can blow out your account trading options, and risk management should be your first concern.

Given what our extrapolations are in the options market, there are a few trades to consider:

1. Put Sales. There are many investors out there that have said "I like facebook, but only in the high 20s." Because of the elevated premium environment and the potential demand for put options, you can take the other side and sell cash secured puts. Selling the Jul 27 put for something like 1.50 would be a great way to get exposure to the stock at a much better basis.

2. Stock Repair Strategies. If you do own facebook stock, you could consider an alternative to covered calls. Instead, sell a call 1x2. This is a strategy where you purchase an at the money option and sell 2x OTM options, where 1 of those options is covered by 100 shares of stock. This helps to reduce your basis on the stock but gives you an extra "kicker" if the stock runs higher compared to covered calls.

3. Put Spread Buys. If you are bearishly inclined, consider spreads instead of straight up put buys. This would be a more-sane way to trade the stock, and the out of the money puts you sell will already have an elevated implied volatility. If you are wrong, the skew will drop and your position won't be affected as much compared to straight up put buys.

What are your thoughts? Let me know in the comments section!