The headlines over the past few weeks have been dominated by Tesla.

Buyout tweets, and SEC investigations, and production numbers... it goes on and on.

When you see all of this noise, you need to ask yourself:

Will reading this help me make money?

Can I actually find an edge in TSLA-- the stock, not the company?

The beauty of technical analysis is that you can filter out the noise and focus on the one thing that matters: price.

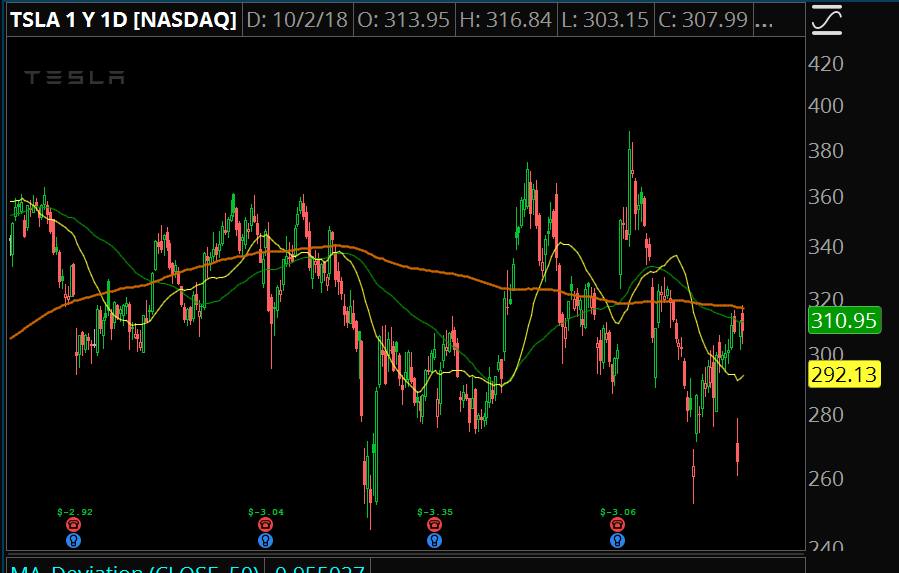

Let's take a look at how TSLA has been trading.

The price action here resembles a pattern that's not mentioned much by traders.

In fact, I may be the only one that knows the name of this pattern.

It's called the HOT FLAMING GARBAGE TRADING PATTERN.

Massive gaps higher and lower, high volatility, and high reversion.

Personally, I know with my trading style there's no way I can get an edge in this stock.

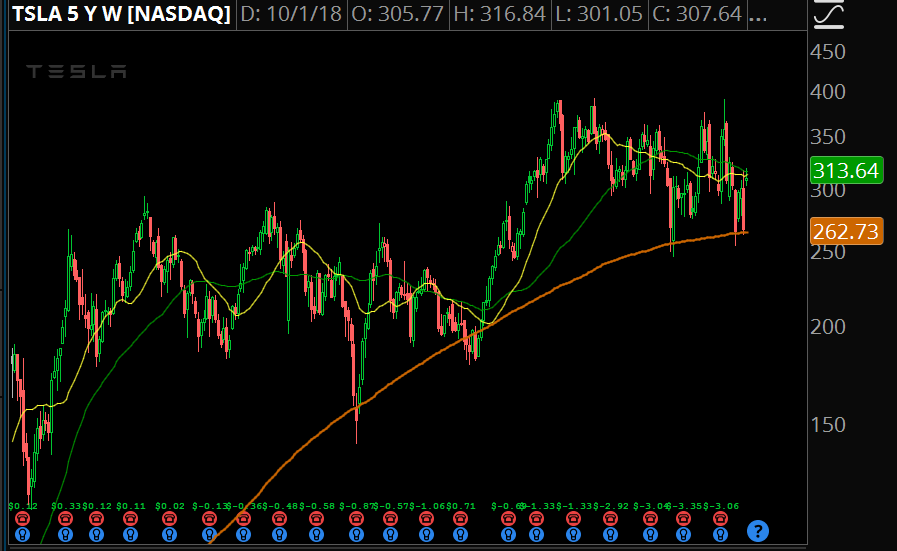

Let's zoom out a little bit more and take a look at the stock over the past 5 years...

Since 2014, there have been only 2-3 "clean" trends.

By "clean" I mean low reversion, low volatility trends.

The rest of the time, it's been a hot mess.

Is it possible to get an edge here?

Sure. You just need to make sure the trading style you use assumes high volatility and high reversion.

That also means high stress.

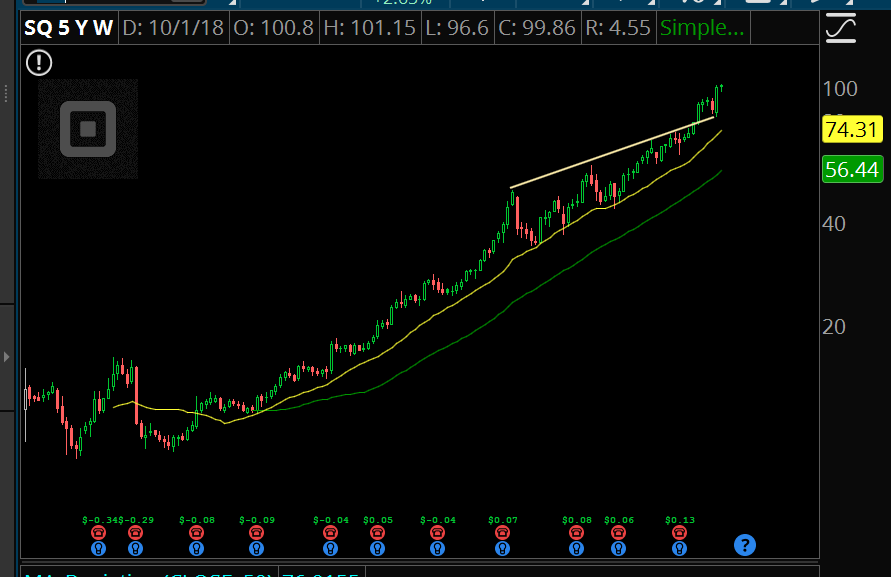

What if there were a way to identify "clean" stocks?

Low stress, low volatility trends higher.

Sure would be nice, wouldn't it?

Like how SQ has traded since 2017:

See how price has a different "feel" to it? Less whippy, not as much chop?

Clean trends?

What if you could identify key changes in a stock where you knew that the stock has gone from a clean trending stock to a whippy, choppy mess?

Here's a great example in Boeing (BA):

The entire year of 2017 was a clean grind higher, and then 2018 was a FLAMING HOT GARBAGE pattern.

Now, it looks as though it's ready to trade "clean" again.

Here's what you should think about to become a better trader today.

How can you identify when a stock is evolving from a clean trend to a hot garbage pattern?

How should your trading strategy change as a stock evolves?

How does your position size and profit taking change depending on how high the volatility and reversion are?

Answering those questions will help you get much, much larger profits and avoid costly option trading mistakes.