Last week, FFIV reported earnings that were a complete disappointment to the street, and the stock ended down double digits. Into that move the options market completely misrepresented the potential move and any option shorts were squeezed out of their positions.

This week, investors are looking towards VMWare to see if the fundamental picture has changed in the sector or if it was just a one-off event in a single company.

Measuring with a yardstick

Measuring expected movement in the options market gets a little trickier as we are past options expiration. Premiums in stock options have two components: time and volatility. The earnings event will play a role in uncertainty and risk pricing, but when there is a lot of time left until expiration, the uncertainty posed by the future can also provide plenty of the option premium.

So just checking the price/strike of an option straddle just doesn't cut it anymore. There's more voodoo behind it, which includes checking out previous volatility drops and extrapolating that assumption to the current market.

Will history repeat?

Over the past 4 events, VMW has seen an average volatility crush of 13.75 points. The Feb 90 straddle can be bot for $10, and if we get a vol drop of 13.75%, then it will be worth 7.35. That means if you buy this straddle, you need to see enough of a move in the stock (delta and gamma) to make up for the vol crush (vega).

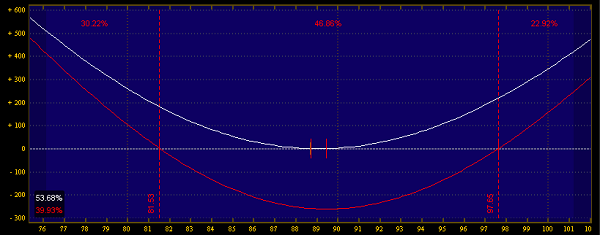

Let's analyze the current straddle modeled with that size of a vol crush:

With that sort of a drop, you'd need a move above 97.65 or below 81.53 -- that's a 16 point range, or 17%! That seems awfully wide, as the past 4 earnings events have seen an average absolute move (close/close) of 7.5%. I have a feeling that more premium is going to stay in the name after the event, so I think a better guess of expected movement is around 10%.

This is more art than science, but it seems like VMW options are bracing for a potential risk move, just in case it pulls an FFIV. If you think they're wrong, then being a net seller of options (iron condors) would be the best choice here.