While the market is still digesting news out of Egypt and potential weight from geopolitical risk, it's still earnings season-- that provides the potential for non-correlated plays with options.

SOHU reported this AM and was up strongly but has faded off. Many of the China internet names are at potential breakout levels, but the bellwether BIDU has yet to report.

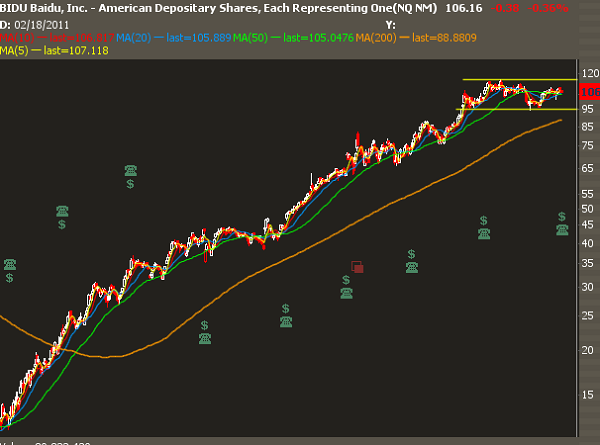

After undergoing a massive trend over the past 2 years, BIDU has been rangebound for nearly five months, frustrating both shorts and longs. Perhaps tonight's report can provide a catalyst that one side of the trade is looking for to break it out of its range.

As of Monday morning's trade, the BIDU options are pricing in about a 7-8% move by this Friday, according to the weekly options board. That percentage estimate corresponds very closely with the 5 month range that BIDU has put in. So if you think BIDU will break that range this week, you want to be a net option buyer, and vice versa with selling.

The average close/close change on BIDU for the past 4 earnings events has been 7.8%, and the max magnitued change has been 9.38%-- so it feels that the current options pricing is coming inline with previous events.

The 30 day implied volatility for BIDU is currently at the lower end of what we've seen for past volatility events; however, that may be a function of depressed market volatility as well as the technical range the stock has been in.

Is there a trade here? Probably. I'd lean more towards double calendars or bull put spreads to play it, as I'm never comfortable with a gun-slinging straight up options long into earnings.