The market might actually close down 1% today.

Which is normal. I mean statistically. The market takes a hit like this all the time.

Don't panic.

A pullback is needed.

This is an opportunity.

From the lows last December, the market rallied nearly 20% without any kind of reversion. This was the strongest rally in 10 years.

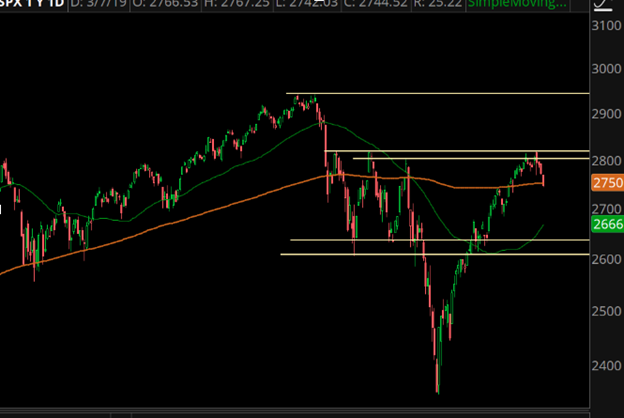

It makes sense that the market is finally finding some sellers. And it just so happens that these sellers showed up at 2800, which has been major market resistance since October.

I’ve been expecting and anticipating some kind of a pull for a while now.

But I’m not looking for some kind of outright collapse.

In a moment I’ll show you the best trade to take in this market environment, but first I’d like to give you my reasons why this market won’t be the same kind of trainwreck it was last quarter.

1. Inventory Cleared Out

Back in December, there was massive capitulation as many market participants went to cash.

Those that needed to sell, sold.

If the total inventory held is reduced, that means supply is reduced. And if supply is reduced it makes it more difficult for the market to auction lower.

2. Massive Stocks Aren’t At Stratospheric Levels

Indexes like the S&P and Dow are market cap weighted indexes. That means large stocks like AAPL and AMZN can really swing the market.

Well, AMZN isn’t sitting at 2000 anymore. And AAPL is trading in the 170s instead of the 230s.

I suppose it’s possible that these stocks can get cut in half again, but odds are they’ll get stuck in range-bound purgatory and it won’t matter as much.

Instead, you can look at QQEW, which is the equal-weighted Nasdaq. It tested all time highs just a few days ago. When I see an index pulling back from an ATH retest, I expect it to breakout instead of outright collapsing.

3. Oil Isn’t Collapsing

Just like the FANG stocks, oil can have an outsized impact on the markets when it’s getting clobbered.

Back in September, crude oil was trading at $75. It’s now trading at $55.

Oil won’t see that kind of move anytime soon. If oil doesn’t collapse, it won’t be the macro “pile-on” that we saw late last year.

Here’s What Will Happen

The markets are setup for a very specific kind of pattern.

We’ve seen a massive move lower, followed by a massive move higher.

Market participation has drastically changed, the price at which inventory is held is much lower.

Odds are, we’re going to knock out some kind of high-reversion trading range for the next few months.

The correction will be rotational. The market won’t collapse, and it won’t breakout either.

Now for most investors, it’s going to frustrate the hell out of them.

Yet for option traders, this is a sweet spot.

We can put on trades that make money when the market is range-bound.

Where you can earn 10-20% on risk within 30-45 days.

While everyone else is getting chopped up to death, you need to look at trading iron condors.

If the market starts to chop sideways, the next few months are going to be easy, passive profits.

I have a step-by-step program that shows you exactly how to trade Iron Condors-- The Iron Condor Bootcamp.

You’ll see the exact entry, exit, and adjustments to take.

This exact trade was used on an iron condor put on about 45 days ago, and it’s closed out today for a profit of $1,650.

I’ve been talking about the coming turn in the market and how we will enter a period of high reversion.

Right now is the time to take advantage of it, while everyone else is panicking about a one percent drop in the markets.

Order the Iron Condor Bootcamp Here

When you become a course owner, you’ll also get a 30-day trial to my trade service, IncomeLab.

The next iron condor setup goes out tomorrow, so take advantage of this now.