I'm a huge fan of trading commodity options.

And you should be, too.

But there are some nuances when trading commodity options that you have to consider if you're going to move some capital away from equities.

These 3 differences are the most important concepts to understand, as they can potentially change the way you trade these instruments.

Fear is In Both Directions

If there is one thing to learn about options is that each contract will have a different implied volatility. You can visualize implied volatility over various strikes by looking at the volatility skew.

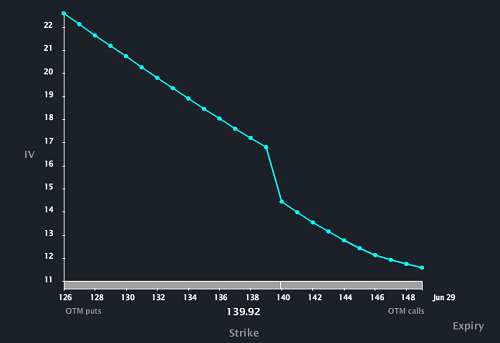

Below is a picture from LiveVol showing the volatility skew for SPY June Options:

Notice that as we go lower in strike, the implied volatility on each contract rises. This is because option traders are willing to pay up for "tail-risk" protection, and most hedgers in equities are fearful of downside.

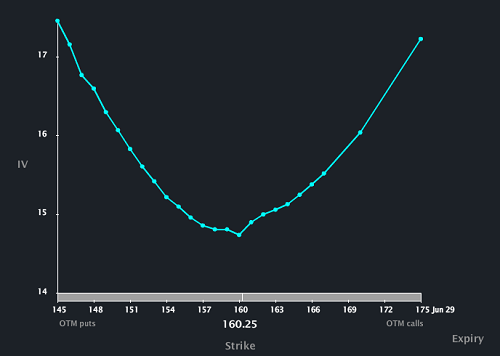

Compare that with the volatility skew for GLD June Options:

Instead of a "skew" we now have a "smile." What is going on here?

It comes down to the perception of risk. Equity investors are fearful of downside in equities. But in commodities like gold, oil, soybeans, and currencies the perception of risk is bi-directional.

That means the tail risk can be on either side.

Think about oil-- if we saw a $20 move in oil to the upside in a very short amount of time, that would have significant consequences across various assets.

So when hedgers and speculators come out to commodity options, they fear strong moves in either direction.

This changes the strategy set used in commodity options trading-- iron condors become more attractive, as do ratio sales after extreme moves.

Commodities Have Different Event Based Risk

Single stock equities can be driven by upgrades, downgrades, earnings, FDA events, insider selling, holding updates, institutional rebalancing, intermarket correlation, same store sales... the list can keep going.

This heightened risk produces higher potential reward-- and for those that want to get more conservative, trading indexes or index futures can mitigate that risk.

With commodity options, the risks that drive movement are quite different than what drives equities. It could be based off supply reports or interest rate changes by central banks.

Because the risks are different, it can give you a way to diversify your trades against different risks. This can be crucial when finding the best trades.

Commodity Option Traders Are a Different Breed

Remember, it comes down to the perception of risk.

Why is risk bi-directional?

Because the motivations in the commodities market are completely different than stocks.

Joe farmer needs to sell his soybeans. Spacely Sprocket company needs to hedge their Euro risk. ZeroHedge has to buy more silver to combat the manipulators.

Contrast that with stocks-- for 95% of the population, investing is the key term. They look to buy stock in companies.

Contrast that to gold and oil: there's no cash flow from these. From a structural standpoint, they aren't "investments."

Because the needs of these markets are different, the demands of these markets are different.

What's going on right now...

I see two possibilities heading into the summer months. Either event-based risk (Eurozone/China) makes a comeback or it doesn't. If we get the first scenario, then correlations will ratchet up among stocks and it will be a macro game again. If the second comes along, then summer volatility and liquidity in equities will dwindle.

Either way, commodity options trading is definitly coming back into my trading arsenal for the next few months.