If you want to be a profitable option trader on the "buy" side, you need to know a few things.

First, you should try your best to let winners run. I know it's hard... because options have a decay element to them, you're already at a disadvantage.

Yet if you can find a way to adjust your trade to hold it through a larger move, you'll be better off.

Second, you should know how to convert your trade when the stock gets a little overheated. This can easily be done by turning call buys into call spread buys.

Free Option Buying eBook

Want to get access to my full approach? Enter your email and I’ll send you your FREE copy of my ebook “Fool Proof Option Buying.”

![]() We value your privacy and would never spam you

We value your privacy and would never spam you

Let's take a look at a winning trade in Citigroup ($C)

The Original Trade Setup

On May 9th, 2017, I sent this video to my clients:

I was looking for the breakout above 60, and given the fact that the stock had gone sideways for months and was making higher highs, it appeared to be a nice low risk, high reward breakout setup.

Specifically, we were looking for a 30 minute close above a key breakout area to confirm the trade. That didn't happen for an entire month.

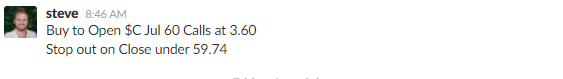

On Friday, June 8th, I sent out this trade Alert:

The next day, the stock exploded higher and we were able to scale out of our position fairly quickly:

By selling half of the trade, we're able to have a little more "breathing room" to stay in the trade a little while longer.

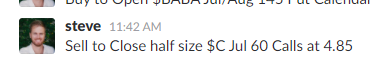

On June 12th, the stock hit my first main target, which caused the stock to become oversold. I sent out this trade alert:

By selling calls against the position, we are able to reduce our directional exposure, cut our time decay risk, and pull cash off the table. The tradeoff is if the stock explodes higher... but because this is a large cap financial, odds are that won't happen.

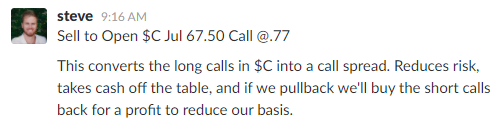

After a 2-day pullback, I put out this trade alert:

After just two days, the sold call has already dropped by 40%. This was also the first time the stock touched it's 20 day moving average since the breakout, which led it to be a good place to get aggressive to the long side.

And because the July 60 calls are deep in the money, there's not as much risk with respect to time decay as there's little extrinsic value left.

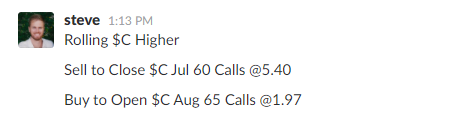

On June 28th, I made the call to roll up the position and push it further out in time:

By rolling "up and out," I get to stay in the position, take risk off the table, and have an extra 30 days of time left in the trade.

The next day, the stock exploded, running from 65 to 67.80 over a short time period.

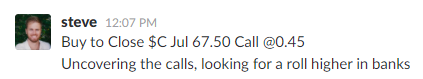

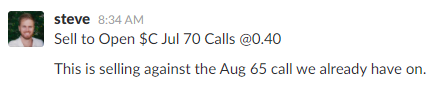

On June 29th, I made the call to calls against the current position.

This turned the trade into a call diagonal. The position was now long the August 65 calls and short the July 70 calls.

After July expiration, those calls expired worthless, and we were just left with the Aug 65 calls.

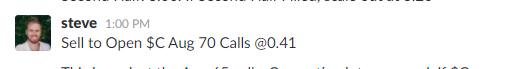

The stock gapped up again and we converted the trade into a bull call spread:

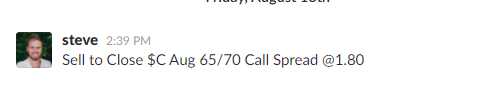

For the rest of the month, the stock didn't see any large movement, so we closed out the trade altogether:

Now this may seem like a lot of things going on... but keep this in mind: the trade took place over the course of two months. It wasn't a trade that we had to "force" one way or the other... we just took what the market gave us.

Trade Evolution Summary

1. Buy to Open Jul 60 Calls at 3.60

2. Sell Half Size Jul 60 Calls at 4.85

This leaves us with half of the calls on, with the first half exited for a gain of $125 per contract.

3. Sell to Open Jul 67.50 Call at 0.77

Converts the trade to a bull call spread.

4. Buy to Close Jul 67.50 Call at 0.45.

Reverts the trade back to long calls, takes $32 per contract off the table.

5. Roll Up And Out to The Aug 65 Call at a 3.43 credit.

Keeps us in the trade for another month, takes $343 per contract off the table.

6. Sell to Open Jul 70 Calls at 0.40

Converts the trade to a call diagonal. These contracts expired worthless, takes $40 per contract off the table.

7. Sell to Open Aug 70 Calls at 0.41

Converts the trade to a bull call spread. Takes risk off the table, and reduces time decay risk.

8. Close the Aug 65/70 Call Spread at 1.80

When the August calls were put on, they had a value of 1.97. And the calls we sold against turned the trade into a call spread with a basis of 1.56.

Because we were able to close the spread at 1.80, it gave us a per-spread profit of $24.

Put All The Profits Together

On the first half of the trade, it ended up with a gain of $125 per contract. A pretty good return... and this is where a lot of traders sit. Problem is, you can miss out on a potentially larger move.

By spreading, rolling, spreading, and spreading, the second half of the trade ended up with a profit of $276 per contract, a 76% return.

Now is it possible that we earn lower returns by doing all of this adjusting? Of course... but it's also possible that you would have had much, much higher risk on the trade if the stock decided to sell-off hard.

Free Option Buying eBook

Want to get access to my full approach? Enter your email and I’ll send you your FREE copy of my ebook “Fool Proof Option Buying.”

![]() We value your privacy and would never spam you

We value your privacy and would never spam you