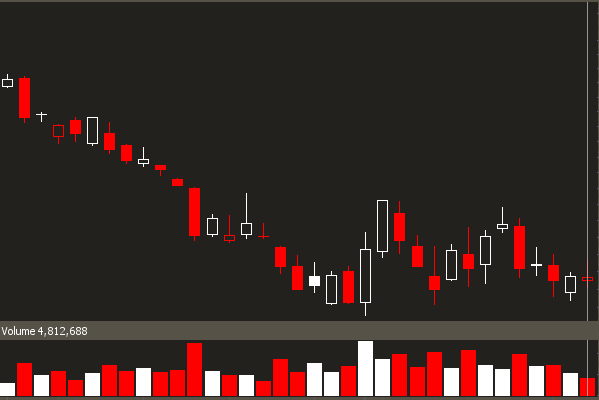

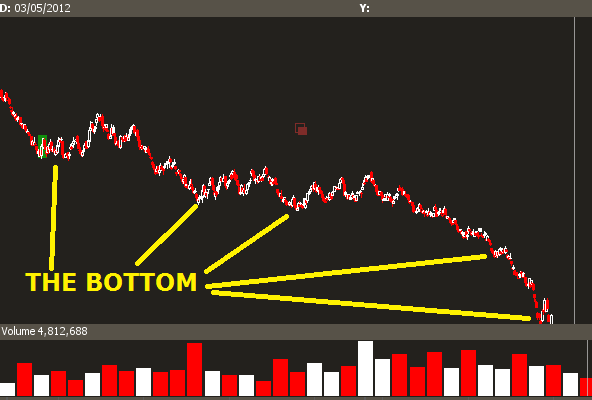

This has to be it. After a capitulative move lower we're seeing some big volume give $UNG a big, fat bounce.

Oh, wait.

That was from April 2011. 10 points ago.

Remember, when you get long $UNG, you are not bullish natural gas.

You are bullish short term natural gas futures contracts, and speculating that the roll yield will "suck less" this month.

Let's take a look at CME Natural Gas Futures, through various months:

Here's the deal-- unless the steepness of this curve is reduced or goes negative, there will be a mathematical headwind in $UNG. So you may be able to trade it, but it's in the same bucket as $TZA or $FAZ in terms of "investability."