Monday morning presented a unique opportunity.

This "kind" of setup rarely comes around, but when it does it can be a wonderful trade.

Let's start from the basics.

Options have two components: intrinsic and extrinsic value.

The intrinsic is the relationship of the strike price to the underlying price.

The extrinsic is the risk premium, and it's where we derive the implied volatility of an option.

But Vol is Not Constant

Each option will have its own individual IV, as traders will pay up for out of the money (OTM) options.

Normally in equities, the higher "risk" is to the downside, so OTM puts will have a higher IV.

This is known as "skew."

Sometimes, however, traders are paying for upside risk as well-- this is known as "smile."

Into Our Situation

$AAPL has been running very hot to the upside, and many traders were looking for strong continuation into options expiration.

So they speculated on a run higher by purchasing OTM calls.

A lot of them.

And by buying a ton of OTM calls, they increased demand and therefore the IV. This made the volatility smile very, very steep.

There are specific trades that attempt to play the volatility surface of options. One trade is known as a "call frontspread."

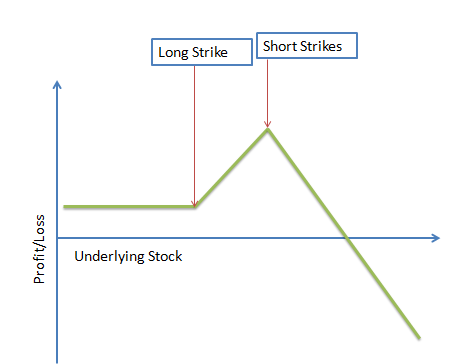

In this trade, you are buying a call option, and selling 2x as many call options that are further OTM.

When the smile is steep, you are essentially selling higher IV and buying lower IV.

This trade makes money a few ways:

- Decent money is made if underlying closes under the long strike at expiration.

- Better money is made if the underlying closes around the short strikes at expiration.

- If the volatility smile normalizes, a profit is made-- this is hard to visualize as it goes into extra dimensions.

The main risk? A blowoff to the upside. Not fun.

So that's what I was looking at in $AAPL yesterday morning, and I put out a public trade idea-- you can watch it below: