Everyone talks about AAPL, but it's all about direction.

Long or short. Up or down.

But as an option trader, I can structure risk around the volatility of AAPL.

We're at a point in which the volatility cycle for AAPL is at its lows, both relative to what is currently going on as well as what the market is currently pricing going into the Holiday season.

First, let's take a look at the actual volatility in AAPL. We can do that by analyzing the Bollinger Bands as well as the historical volatility.

See how the Bollinger bands are "pinching" in? It shows us that volatility has compressed over the past month. This cannot persist, and we will most likely see volatility expansion as well.

Also, the current HV reading is around 17, which is pretty low.

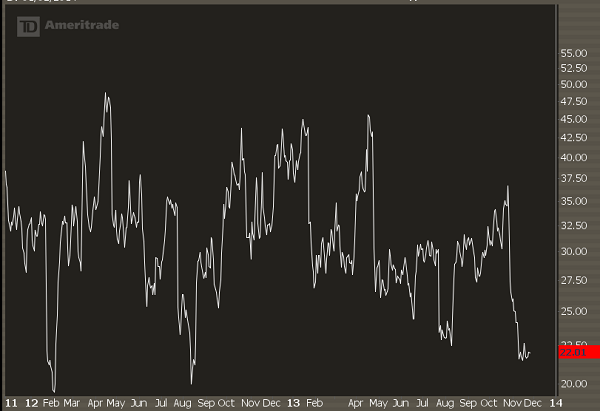

The next thing to look at is the implied volatility of AAPL options. This is what the market is currently expecting in the future.

We can look at this quickly by viewing VXAPL, which is the VIX for AAPL options.

A reading of 22 isn't the lowest we've ever seen, but it's pretty low relative to the past two years.

So what does this all mean?

First, AAPL has been too quiet for too long. Stocks only stay in ranges for a certain amount of time, and then we see a move out of those ranges as either buyers or sellers exhaust themselves.

Next, AAPL options are pretty cheap. If you're looking for a move in AAPL you want to be a net option buyer, not seller. Any sort of actual move in the stock will most likely be accompanied by a pop in AAPL option implied volatility.

Finally, we are coming into the holiday season. Investors will be watching AAPL for sales numbers, so there may be some catalysts in the next 30 days.

The trade here is pretty obvious (long straddles), but if you want to see exactly what I'm trading, you can become a member of IWO Premium. Get a 2 week trial for $14.