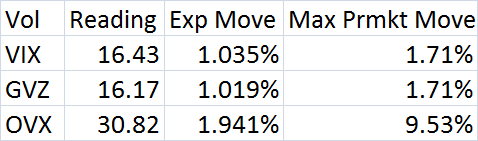

At the time of this article we are seeing some voodoo going on in North Africa and the Middle east, and that is affecting various asset classes, including gold, oil, and domestic equities. These moves that came over the holiday weekend are fairly strong compared to what the market is pricing in the near term options:

So is this a one off event? Will realized volatility settle down going forward?

WARNING: Big mathy words ahead, but they're important to understand!

Probably not, at least that's not how we model financial prices. There's this big, complicated term: "Autoregressive Conditional Heteroskedacity," also known as ARCH, which is a price model often used for financial movements. The details are not as important as the concept that I want to get across:

Volatility in markets tends to cluster, and

Volatility begets volatility.

That's what that big word "heteroskedastic" means: different dispersions-- it means that variance is not constant and that a time series of financial prices will go through quiet periods as well as significant increases in volatility due to significant shifts in risk perception and supply and demand.

As of this moment, I'm not sure that equities will see significant increases in volatility as we are seeing a premarket bounce and the last time North Africa news occurred it was bid up immediately that day.

But oil is putting in a move that significantly changes the market structure, and it is breaking past levels not seen since the 2008 crash. It certainly is making for some interesting times.