Every so often, GOOG will come out with earnings the day before options expiration. This is a very unique opportunity in the market in which wild swings happen overnight and people use options to try and take advantage of the situation.

When options are traded, there is a certain uncertainty on where price will be tomorrow-- if we were certain then there wouldn't be a market! So with this uncertainty, there are traders looking to buy insurance and speculate for a large move, and there are traders looking to sell insurance for a not-so-large move.

The expected "move" can be seen in the options through the implied volatility-- it's related to the amount of extrinsic value of the option. So what we can do for GOOG is look at the volatility in the options and see what move the market is pricing in, and see if we can choose an over/under.

To approximate the expected move we can look at an ATM straddle (selling a call + selling a put) and divide it by the strike price of the straddle. This is price/strike. Currently the 440 straddle is selling for 21.50, so 21.50/440 = 4.8%. So we're looking at an expected range of {461 418}.

So if you think that GOOG is not going to have a large reaction to earnings, you can sell volatility via selling options-- straddles, strangles, calendars, and diagonals all accomplish this.

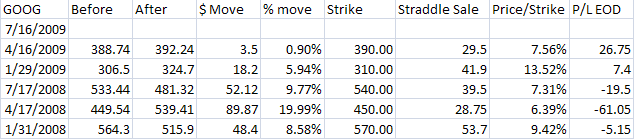

Now has selling GOOG volatility before earnings been a viable strategy? I took a look back at the closing option prices to see if selling an ATM straddle would have worked.

Assuming the data is correct, it's not been much of an edge, due to the blowout from April of last year. Do note that not all GOOG earnings are right before opex. There have been other selling strategies that may have worked (strangles) but this gives us a rough approximation of how options have behaved as a result.

Disclosure: short vol in GOOG at time of writing