If there's any super obvious theme in the markets right now, it's the rotation out of risk.

This means small cap stocks have been underperforming the market and have the potential to make a longer term top.

It's Getting Ugly

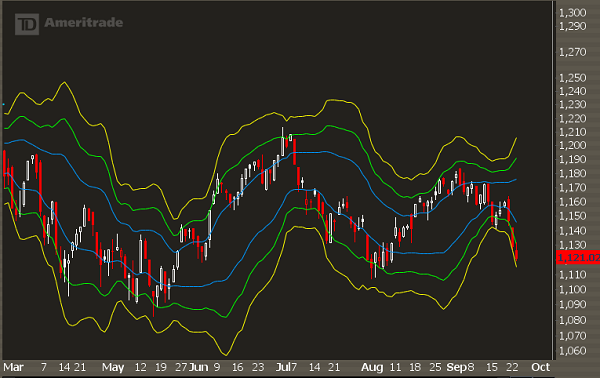

A look at the Russell 2000 shows how much damage has been done:

After an attempt to stabilize around 1160, sellers stepped up aggressively on Friday and we have seen continuation to the downside.

Is this a long term top?

I don't know.

I trade options that are a month or two out, so I don't have to worry too much about it.

But since the Russell has been selling of so hard, investors are getting scared and bidding up the implied volatility in RUT options.

And most of the demand has been on out of the money puts as investors fear extreme downside rather than moderate downside.

Taking the other side of this trade is what I want to do.

The Trade Setup

Buy to Open RUT Oct 1090 Put

Sell to Open 2x RUT Oct 1080 Put

Buy to Open RUT Oct 1060 PUt

Credit: 1.10

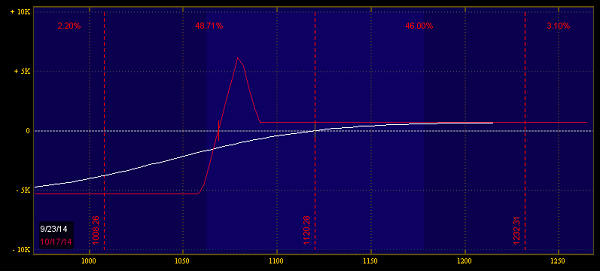

This trade is a broken wing butterfly. It's called "broken" because the distance between the long strikes are not the same. This helps to bias the trade so you can collect a credit on a move higher.

The Risk and Reward

This trade makes money a few ways:

1. If the RUT rallies

2. If the RUT sells off slowly

3. If the RVX goes lower

4. If the option skew goes lower

Given how far we've sold off already, all of these seem like good odds.

The major risk here is if the RUT sells off aggressively. The downside breakeven at options expiration is 1070, which would require another 50 point selloff in the RUT. This is unlikely, but possible.

The maximum capital required in this trade is $890.

If RUT rallies you keep the credit of $110, giving you a return on risk of about 12%.

If RUT continues lower but settles around 1080, you can see outsized returns, but the odds of that are very low.

If you want to see how we do this in real time, get a 2-week pass to IWO Premium for $14. Trade alerts, nightly videos, video training, and a chat room. Get the pass here.