Sounds weird, doesn't it?

"Pullback."

It doesn't really roll off the tongue like it used to.

But here we are, in the midst of the strongest post-WWII bull market, and I'm looking for some sellers to step in.

Does this mean I've gone full ZeroHedge on you?

Nope. Never go full ZeroHedge.

I just want to layout a case for a move lower, so you can be prepared for it.

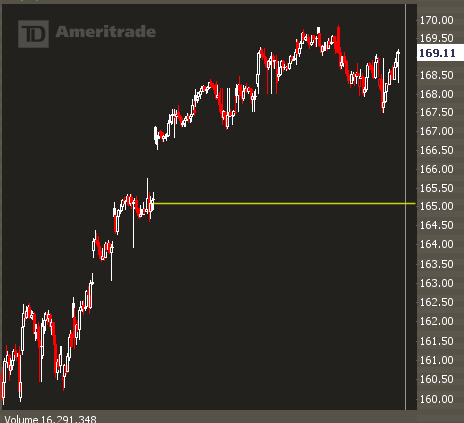

1. There is an unfilled gap

2. The S&P has broken its trend and is putting in a topping process

2. The S&P has broken its trend and is putting in a topping process

3. The Yen is failing to roll over

For confirmation, the SPY would need to see a hold under 167.50.

This thesis is wrong if the S&P breaks above 1700.

Measured Moves

But what kind of targets are we talking about?

Well, the height of the topping pattern is about 2.5 points, so that puts our target around 165.

That coincides with our unfilled gap along with rising 50 day moving average.

And I think this will be a constructive pullback in this bull market.

After all, 165 is only a 3% correction, which seems "normal" in most markets.

But it won't feel like it.

Everyone will start saying how "this is it" and the VIX will spike and people will unload on their positions.

So this leaves you with a good lesson-- timeframes matter. You can be short term bearish or neutral, but still have the context of a bull market.