The Anticipation is Killing Me

The Anticipation is Killing Me

For nearly a month, AAPL has been frustrating directional traders both long and short as it continues to trade in a super-tight range. I believe that the stock will come to a technical resolution very soon... but I've little idea on which way it will break.

The overall trend is up and there's technicals to support that, but I feel if those technical areas are violated there's going to be a strong liquidation. This would be a case in which I am bullish on volatility, but neutral on direction. Thanks to options, we can trade off that thesis. Here's 2 ideas for you to take advantage of the situation.

The Theta-Face-Melt Straddle Buy

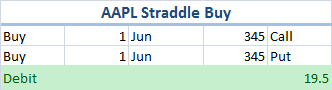

This one is not that sexy and is psychologicall damaging if you're incorrect in your trade thesis. Here's the trade idea:

This trade is a limited risk, unlimited reward trade that makes money if AAPL sees a strong move. The problem? With that limited risk comes time decay-- since you are buying options with extrinsic value, that will go lower over time:

If you get a run to 360 very soon, you get a nice return. If the stock breaks down, you'll get a positive vega boost which will help your position. But if AAPL continues in limbo, you lose money. There are ways to reduce that theta by selling weekly options against this position, but it does require some agility.

The Roll the Dice Double Butterfly

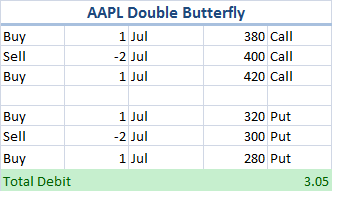

Let's assume that AAPL will breakout of its recent range and continue to a nice round whole number. Either 300 or 400. Can we play this? Sure, but the trade gets a little tricky.

Consider this trade:

Now there may seem like there's a ton of moving parts, but it's just a combination of a put butterfly and a call butterfly. This is a low risk, high reward trade-- and because of that, the implied odds are much lower. This trade will make money if AAPL price is in the range of either the call or the put ranges. It's much easier to see graphically:

And here's what it looks like on the chart:

This trade may seem a bit like a lotto-ticket, and it is; however, if AAPL does break out or down out of the range, the target would be a measured move of the current range, which is 40 points, so with that in mind, it doesn't seem that far off.

These are just some fun ideas that I'm toying around with that aren't really in my wheelhouse, so take them at your own risk. But whatever position you take, I feel that AAPL vol is a buy here.