Welcome to the 5th lesson in your “Option Trading Tactics Bootcamp.” Here we cover the most important trading rules new option traders should follow. By adhering to these option trading principles, you will become a more consistent, confident, and profitable options trader.

Welcome to the 5th lesson in your “Option Trading Tactics Bootcamp.” Here we cover the most important trading rules new option traders should follow. By adhering to these option trading principles, you will become a more consistent, confident, and profitable options trader.

If you’re new to this series, check the past lessons at our Bootcamp Headquarters.

To make money in options trading it's not just stock selection that can cause risk, but also option selection... specifically over time.

Short Term Risks

Many seasoned option traders will forego the riverboat casino that is options expiration and only trade options that have more than 2 weeks left to expiration.

This holds especially true for "income" type trades that are short gamma by nature-- if you try and milk out every last penny of an income trade, you will run the risk of getting cut by the gamma knife edge and letting profits turn to losses in the blink of an eye.

This holds especially true for "income" type trades that are short gamma by nature-- if you try and milk out every last penny of an income trade, you will run the risk of getting cut by the gamma knife edge and letting profits turn to losses in the blink of an eye.

The same siren song can occur for directional option traders. You may look at near term options and say they are "cheap" and offer plenty of leverage for the cost. But odds are you are neglecting the theta cost of those options, and the actual odds that you have on the position.

Or flip it around, you could think that since an option has a theta of -50 with 4 days left to expiration, that somehow you'll be able to make 50 bucks a day just by selling those options, without any respect to the gamma risks in selling short term options.

The desire for newer traders to trade short term options is compounded by the fact that weekly options have become much more widespread in many options, so every week can behave like options expiration.

This point leads me to the next principle new option trades should follow:

Principle #4: Don't Trade Close to Expiration

We'll dive a little further into option greeks so you can get a better understanding of what risks you take when trading short term.

The Gamma Knife Edge

Gamma is a stock option greek that makes options trading so fun. It can be referred to as the "acceleration" of the option. If you are long gamma, you want fast moves; if you are short gamma, you want the underlying not to move at all.

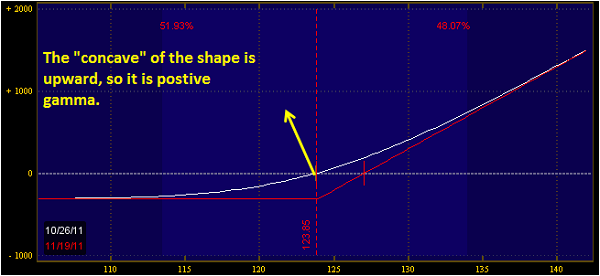

It's also known as the second derivative, which doesn't mean much unless you are viewing a risk graph:

Gamma is a wonderful thing, and it is directly related to the amount of time decay available in an option.

You can consider gamma to be like fire: under controlled situations, it feels good and warms your house. But if it gets out of control, it can be a very destructive force.

Where It Gets Tricky

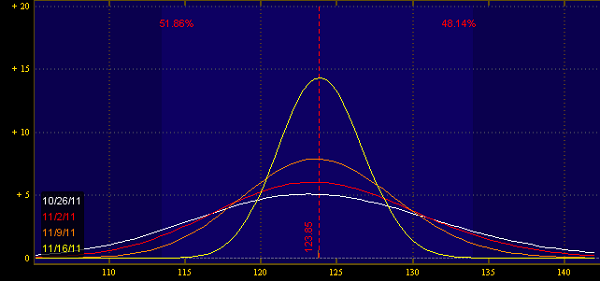

The chart below shows the gamma of a call option buy, plotted over time:

What does this tell us? On out of the money options, the gamma will start to decay, as those options lose their effectiveness. But as we approach options expiration, gamma drastically increases on at the money options. This increase is what I affectionately term the "gamma knife edge," and it's where many new option traders get cut.

See the other side

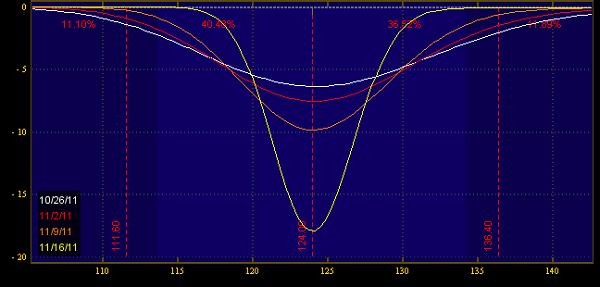

Remember how I said gamma and theta were linked? Here's a chart of theta over time:

So not only do you have a significant increase in gamma, you also have a much larger amount of time decay in options.

Funny things start happening to options as we approach expiration. The pricing models start to get a little weird, and you could potentially be taking on more risk than you thought-- regardless of whether you are an option buyer or seller.

Regardless of your trading style-- if you are a new options trader and just beginning to understand the mechanics of the options market, stay away from short term options. Opex trading and dancing around the gamma knife edge is a dark art that requires a level of agility that isn't often seen in new option traders.

Once you get a better feel for the market and you feel that opex trading will match your trading style, then consider adding short term options to your trading strategy.

Let's move on to the next lesson so you don't treat the market as a casino...