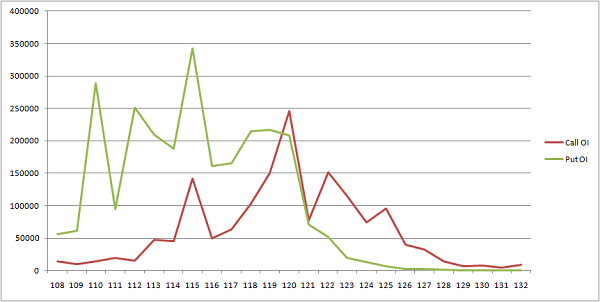

Here' s the current open interest on SPY contracts:

So the current ATM strike (120) really doesn't have that much open interest here. This isn't bullish or bearish directionally, but what you generally want to see for a "pin" is the open interest to provide enough supply or demand in the underlying to keep price rangebound today. It's not an easy call to make here, but it probably will happen.

If we look at the put open interest, we see that the majority of contracts are pretty far OTM. That means there isn't going to be some wildly volatile flush out as the options shorts are forced to cover. If anything, that big spike in the ATM call OI will most likely keep a lid on prices, at least for today.