Why you need to stop looking for the right or wrong answer.

I have a theory about trading.

This theory has come about through my experience transforming hundreds of people into great option traders.

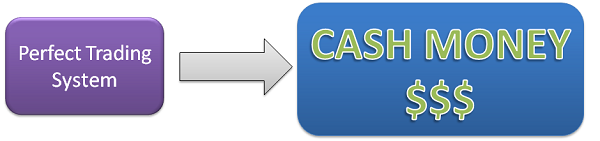

Let's say that you have a profitable trading system. And it's perfect.

So perfect that we actually know with 100% accuracy that it will be profitable in the future.

I believe that if you give that system to 100 people, no more than half will make money with that system.

Why is that?

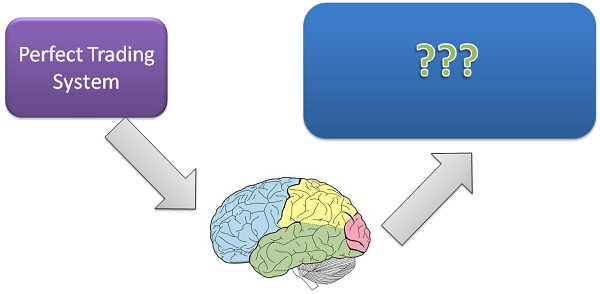

It's because traders don't know the systems, and they don't know themselves.

How you are as a person will determine what kind of trader you will be.

If you've spent any amount of time online in trader forums, the arguments always boil down into what tactic is the best.

Should you use technical or fundamental analysis?

Should you use simple or exponential moving averages?

Should you trade momentum or value?

Everyone thinks they have the right answer and they want to make sure you know they are right.

But there is no right answer, but plenty of wrong ones.

For me personally, I know that I can't trade deep value. I don't have the patience for it as it requires a lot of work and not that many trades. I know that I enjoy being active in the market and I like to play the same stocks over and over again.

For me, this is the right answer. For you-- I don't know.

Step #2: Know Thyself

To be a successful trader you have to understand how you interact with your systems, and whether they will be successful for you.

Defining your trading style is much more important than figuring out what the best moving average to use is.

Here's what you can do next.

Find your trading affinity. Read the classic texts - Livermore, O'Neil, Graham, and so on. You will be more attracted to some concepts and trade setups than others. Start honing in on the craft you are willing to develop.

Find your trading affinity. Read the classic texts - Livermore, O'Neil, Graham, and so on. You will be more attracted to some concepts and trade setups than others. Start honing in on the craft you are willing to develop.

If you don't know where to start, I've got a great list of books to start with.

Also--get on social media and start following different traders and investors.

Examine their trading style and see if it's right for you. If you are a fundamentally oriented investor, odds are you don't care about forex trading. If you love fixed income trading, you probably want to stay away from penny stocks.

It's not just about being passionate about trading. You need to understand yourself before you can put capital at risk.

Already know your trading style, and are looking to make it profitable? Great-- stay tuned for the next step in the Trader Success Plan.