“Everybody has a plan until they get punched in the face.”

If you've ever bought a book on technical analysis, you've been lied to.

You're shown these magical chart patterns that show how ideal one setup is and how easy it is to trade it.

Just buy at support and sell at resistance... it's that easy!

And you start to believe in the magic.

It works, sometimes. But other times... not so much.

Let's see if you've been in this kind of trade.

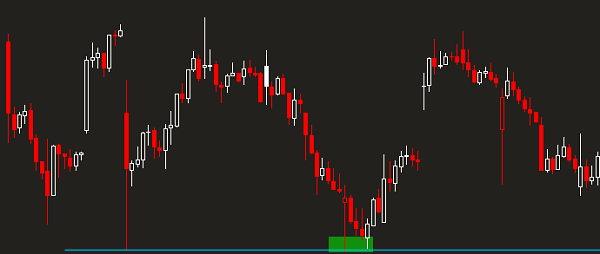

You buy a stock, or call, or contract. It goes your way for a little while and you're just so pleased with yourself. But all of a sudden the bid just drops out of the stock, blowing past your entry and then taking you out as you get stopped out.

No big deal, losses are part of the game, right?

But as soon as you stop out, the market rips right back to where you entered, and back to where you would have been profitable.

You got shook out. And not only did you lose money, you lost mental capital as you now feel stupid.

If you've traded for any amount of time, it's happened to you. It's happened to me too.

Why This Happens

The thing is, everyone knows what the textbooks tell you. Everyone knows what a double bottom is, or a bull flag, or a falling wedge.

Everyone knows exactly what price the 50 day moving average is.

Let's think about this on an institutional level.

Pattern recognition has, to some degree, gone algorithmic. That means funds and quant traders have little black boxes that understand these market patterns.

They also know the prices that you'll get stopped out at.

Pretty disheartening, right?

But here's the thing... now you know what happens, and you can adjust your trading around it.

Instead of blindly following chart patterns, ask yourself...

- where would I place my stop?

- where would the shakeout trade occur?

- how obvious is the pattern?

If you can answer these questions, you get an edge. You can play the chart patterns not only when they work, but when they fail.

Because it's never as clean as you think. That obvious support level you want to buy into will probably have price overshoot past it to make sure everyone stopped out and the strong hands can come back in.

That's a part of what we teach in our Swing Trade Secrets class. How to identify failed breaks and profit from them.

Get Swing Trade Secrets

If you want to learn how to trade failed breakouts as well as my 7 favorite chart setups, then signup for this course.

Order on Our Secure Server

As with any products from IWO, you are protected by a 60 Day Guarantee. If you feel that the course isn't right for you or doesn't match your trading style, then just contact us and you will get a full refund.