$GLD has been a wild ride over the past few months. But it has been a mean-reverting one.

Non-directional income trades have worked fairly well here, provided that you have gone far out enough in time to mitigate the gamma risk-- see more about understanding the greeks here.

Some Chart Art

Let's take a look at a 6 month chart of $GLD:

Gold has acted as a risk-off theme, especially starting in August when it went parabolic on the Eurozone news (my thoughts on that here).

Since then it had a pretty nasty correction, slowly drifted for a while, then caught a bid and a breakout.

Either way, there are clear support and resistance levels to deal with, so an income trade could be a good bet here.

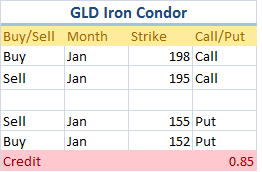

Consider the Trade

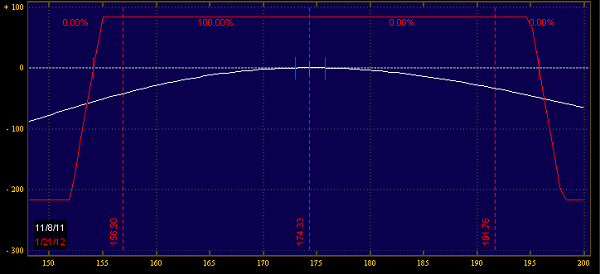

This trade is limited risk, limited reward. It makes money provided $GLD stays within the short strikes. Here is a graphical representation:

The Stats

Max reward: 85

Max Risk: 215

Reward/Risk: 40%

Why this Trade?

Now many newer traders may ask why take a trade that only offers a small amount of reward relative to your risk?

The answer lies in the fact that you have a very wide area of profitability. Provided $GLD can stay above 155 and under 195 then you will end up with a profitable trade.

Devil's In the Details

Because the trade is in January options, the time decay (theta) will take a while to manifest itself. Think of the trade more like a "slow cooker" than a "stir fry" of directional trades.

However, this is not a set and forget kind of trade. You need to account for how you will manage your directional risk (deltas) as well as what to do if a multi standard deviation occurs in a short amount of time. This is why you need to fully understand the real risks in this trade.

Worth a Shot

We'll be looking to deploy this or something similar in the Model IWO portfolio. We go beyond ideas and focus on position sizing, risk management, and adjusting a position to cut risk and enhance returns. You can learn more here.