Trading on a Framework

Trading on a Framework

If you're a new trader one of the best ideas to conceptualize is the fact that markets do move in cycles, across multiple timeframes. There's many different ways to define this trend, whether it be price patterns, moving averages, or other structures. It's said that if a you can figure out the proper timing in a market cycle, then the odds will favor your trades.

The Supply and Demand Wave

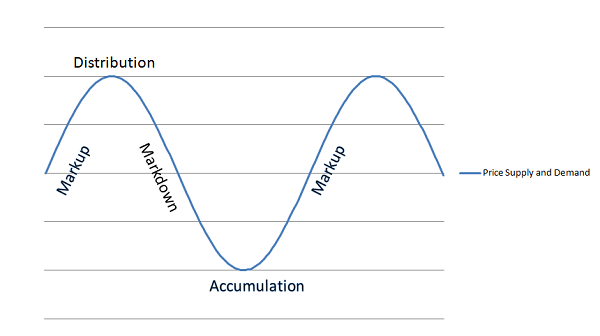

When basic technical analysis looks at this concept, the general cycle is considered broken into 4 parts: accumulation, markup, distribution, and markdown. We can put this in pictures by considering that price patterns often resemble periodic cycles, which often go along with behavioral finance patterns:

The Missing Framework

This is why I believe it's so important to have the proper options education. We know that in options there are two sources of supply and demand: the stock and the options premium. This premium is reflected in the option pricing models.

What conclusion can we draw from this? That there are multiple cycles outside of strictly price action. I believe that we can quantify 2 other cycles.

The Trend/Reversion Cycle

Often when a stock or market goes from markup to distribution or from markdown to accumulation, we will see the trend weaken and we go into a state of "mean-reversion." This means price is currently agreed upon and that any attempt to move price outside of a price band, sellers or buyers will come in as they believe price has moved out of value.

Mean reversion can occur on multiple timeframes as well-- there's a specific subset of technical analysis known as auction market theory that goes more into detail about this-- I highly suggest reading "Mind Over Markets" to get a better feel of what I'm talking about.

So we know that the market has a much lower tendency to mean revert during markup/markdown phases. In fact, that's what we know as a "trend."

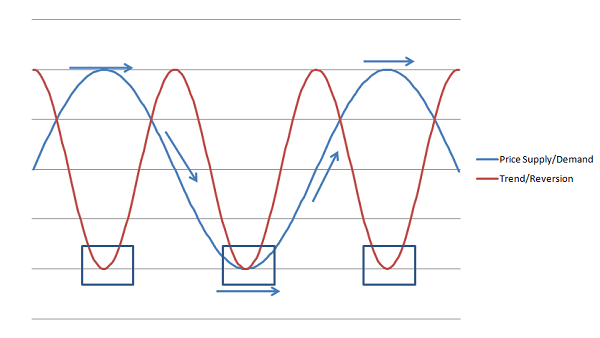

Quite often, stock price movement can be modeled very similar to what we see in signals and communication. In signal theory, we can take a signal and change the frequency and shift it "out of phase," which essentially means we put it on a time delay. This is essentially how we can find the relationship between trend/reversion and price supply and demand, as we know the odds of mean reversion are higher during accumulation/distribution phases. When we compare the overlay between the price supply/demand wave and the trend/reversion wave, we get something like this:

We can see that the red line hits a trough (mean reversion) when supply or demand are peaking, and it hits a peak during the middle of markup/markdown phases.

The Volatility Cycle

This framework comes from having a deep understanding of how the options market operates. Often what we will see during a strong markdown phase in the markets is an increased state of fear by investors-- and with that fear they are willing to pay a higher price for protection in an asset.

We can take the inverse of this relationship-- we know that as an equity market runs higher, investors have less fear and more complacency, so the demand for premium goes lower.

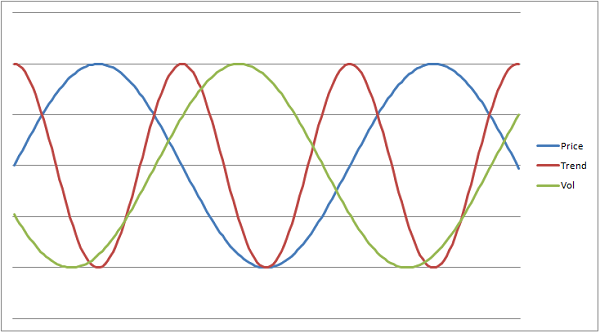

When we take this volatility cycle and overlay it on the third chart, we have a leading "phase shift" relative to the supply and demand cycle:

Does volatility tend to lead markets? It's a more complicated question than that, but there are divergences with respect to how much investors want to protect themselves-- this does require a little nuance, but you can see how these relationships start to take hold.

Putting It All Together

If you can learn to conceptualize these three market cycles, you're going to have an edge in the market. If you see that the volatiility cycle may be putting in a bottom and there may be signs that we are going into a mean reverting market, it may make sense to sell bear call spreads.

Another example, if you think that a market is still in markup mode but a smaller cycle is going from mean-reverting back to trending, it may make sense to buy calls or buy call spreads.

My Secret Sauce

This is just one ingredient that I use when putting trades together. I've got my playbook fully out in the open with my video trading education as well as my trading service. Check them out if you want to go further down the options rabbit hole.