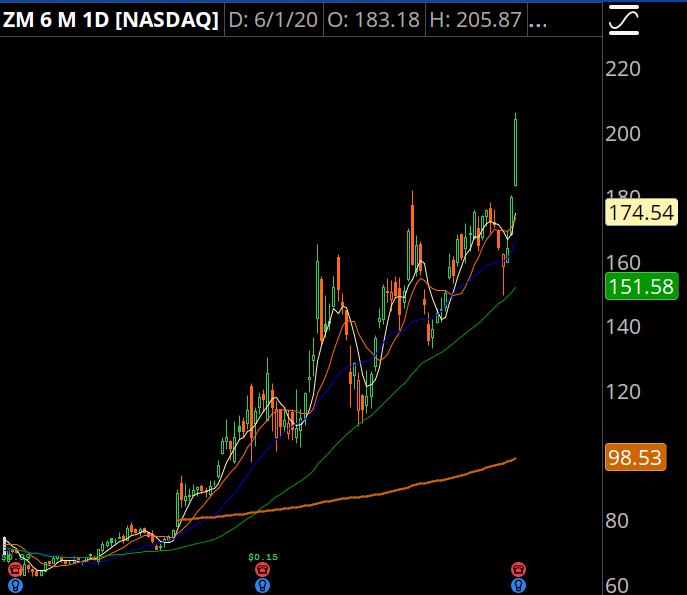

Zoom reports earnings after the close, and the stock is on an absolute tear higher into the number.

Question now is... how much of it is currently justified?

Before we go down the rabbit hole, keep in mind that I'm a paying customer of the company. It's a very good product.

I've also made plenty of money playing it to the long side, as have the clients in my IncomeLab Membership. As an example, here was a video analysis of when we played it to the long side:

So this isn't some permabear short.

But I want to run through some back-of-the-envelope numbers to ask if this makes sense...

Check Out The Size Of That Thing

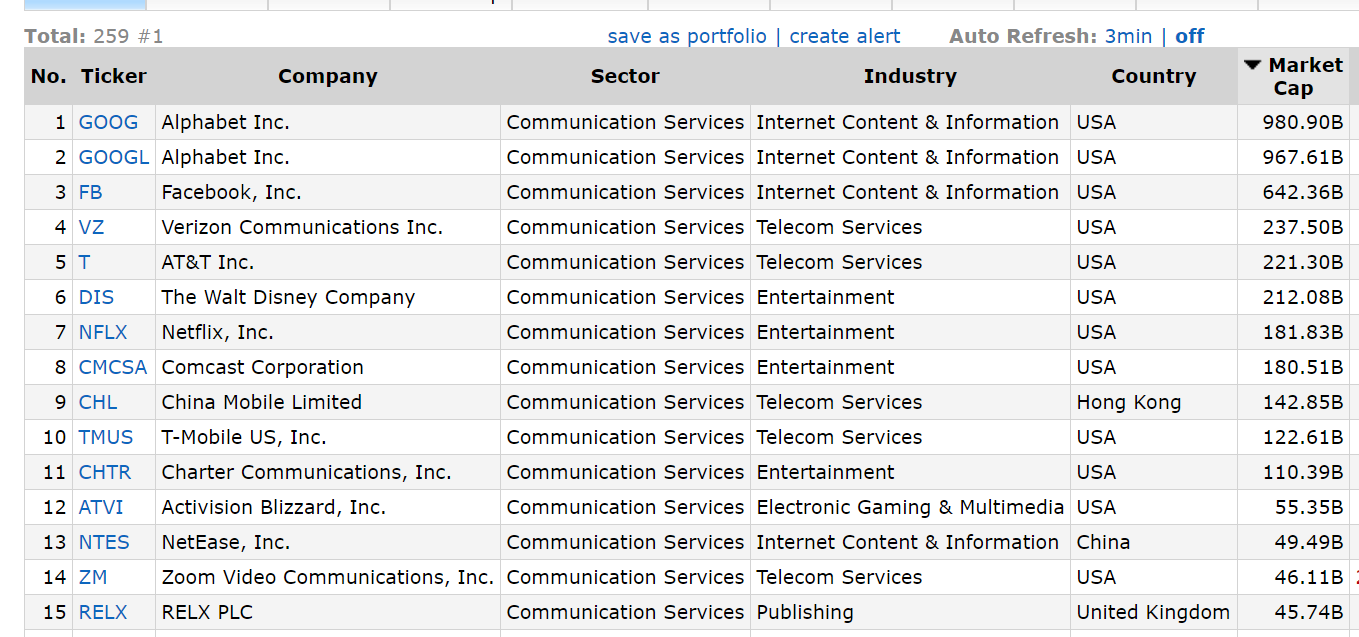

Zoom does webinar and meeting software, and that puts it in the "Communications Services" sector.

It currently is the 14th largest company in the sector. Here's a screenshot from finviz:

So the larger companies above it are the mammoths. Google, Facebook, Verizon, AT&T, Disney, Netflix. That all makes sense. And this isn't a true apples/apples comparison because ZM is a tech growth company.

Yet...What about the companies under it?

You've got BIDU, the Chinese internet giant.

You've got Electronic Arts, which makes a TON of video games.

And right now, the stock is about twice the size of TWTR, TWLO, SNAP, and MTCH.

Now consider these companies, what they sell, how much they sell, how many employees they have, the properties they own... and compare it to ZM, which, for now, is a single product line.

That feels a little out of whack.

Can The Growth Justify The Valuation

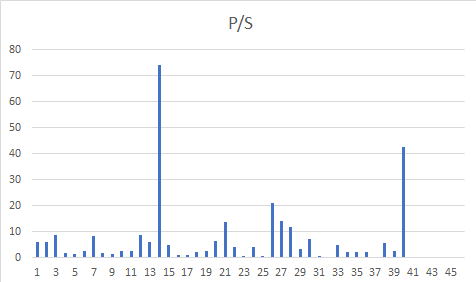

Let's go back to our list, and we'll take the largest 40 companies in the sector and look at their Price/Sales Ratio. I've removed LBRDA and LBRDK out of the screener.

Guess which one is ZM:

Yeah the price is a bit rich relative to their current sales.

But remember-- the stock market doesn't price in what the company does right now, it prices in what investors expect in the future.

ZM is trading above $200/sh because investors have the expectation that sales are going to grow. A lot.

We can use another finviz screener to see if this passes the smell test.

We'll look at all companies with a market cap over 10 billion with a P/S over 10.

That gives us 94 stocks. I've ranked them from highest P/S:

Again, LBRDA and LBRDK look like a special case... but the list gives us the "usual suspects." Many of these companies are the growth companies that have held up incredibly well in 2020, and many are breaking to new highs. If you had invested in these 20 stocks, your average YTD gains would be 65% and the median performance was 50%.

Back to ZM...

There are only two other companies with a P/S:

MRNA which is trying to get a COVID vaccine pushed through, and

DKNG which is going to let everyone gamble on nearly everything online.

And that's it.

Odds are, as ZM comes into its earnings report that they will show sales growth, and the P/S will normalize a little bit.

But at 74, that looks a touch rich.

What's Possible Vs. What's Probable

The way ZM has moved, it could be that investors just absolutely nail it and the company reports massive numbers and guidance.

But how much is already priced in? The stock is up 13% today and it hasn't even reported earnings?

Odds are much of the good news is getting baked in before the number, and the upside risk is lower than what the options are pricing in.

For the record, I sold ZM 12Jun 250/255 call spreads. They're far out enough in time to allow me to manage risk if things get weird. And this is an earnings trade so I don't have a ton of size on as the expected risk of shorting the strongest growth stock into earnings... well yeah that risk exists.