This case study will show you a unique trade setup that returned 78% in 8 days, with almost no drawdown at all.

I'm sharing this with you to show how sometimes... many times... you can get amazing trade setups when you combine two trades on the stock market and volatility market.

In this case study, you'll get the setup, the reasoning for the trade, and all adjustments. All the entries, adjustments, and exits come with a video taken live. This allows you to see the total approach when facing extreme uncertainty in the market.

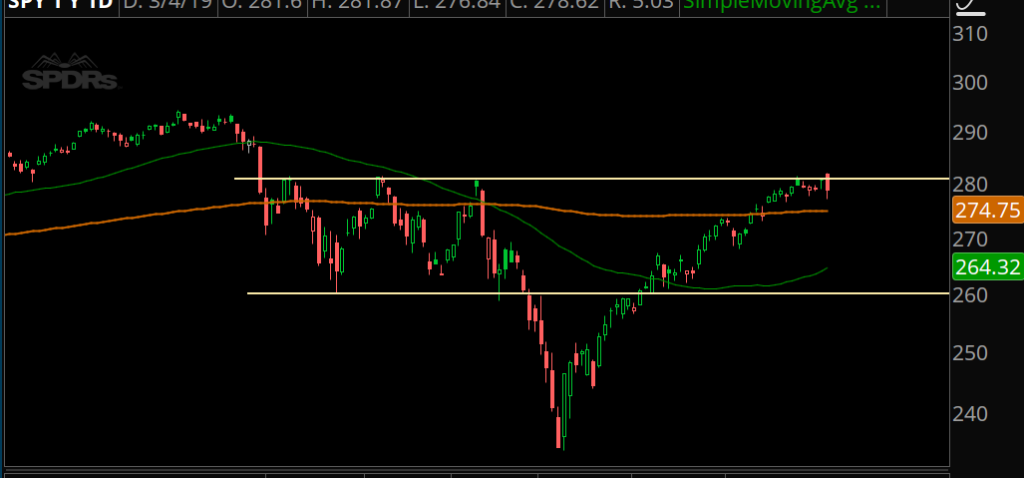

How the Market Traded Into December

At the time of this post, December 2018 is just a few months past us.

It was the worst price action we've seen in a decade.

(Since then, the market has been a rocketship higher with no pullbacks.)

(It was the best price action we've seen in a decade.)

From a statistical and psychological standpoint, it was not a "normal" market. There tends to be more back and forth, and more reversion.

As we headed into the end of 2017, liquidity disappeared. The bid dropped out, and a catalyst came out with some Fed news that dropped the market under 2600.

After 3 days of selling, I wanted to position myself for an oversold bounce, but I knew that oversold markets can end up more oversold.

Spoiler: the market got more oversold.

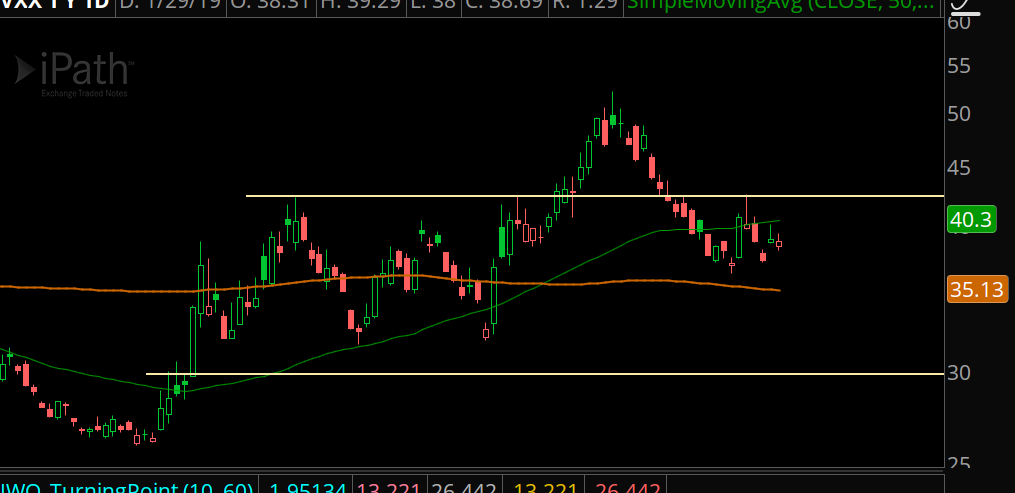

Volatility Didn't Budge Into A Crash

While stocks were getting their faces ripped off... the volatility markets hadn't budged. Spot VIX was sitting right around 25, and VIX futures weren't exploding higher.

That was the "weird" part... and that's where I found the edge.

Here Was The Bet...

With the market breaking down under 250 and the VIX not making a higher high, I expected two things were playing out.

Either:

- The volatility markets were smart money and we were about to slingshot higher, or

- The volatility markets were being stubborn and will be forced to buy-in, which would cause a cascade higher in the VIX, VIX futures, and VXX.

By properly structuring my risk, I could bet for a pop in the market while keeping my position hedged.

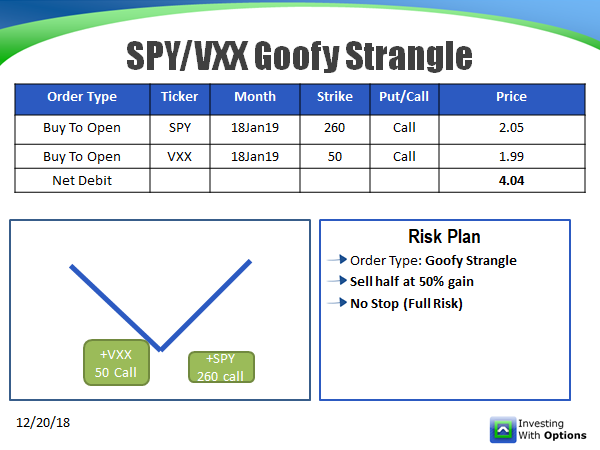

I called this setup a "goofy strangle."

The Full Video Analysis

At IncomeLab, I help clients find and profit from smart options trades.

The extra step, and the true value that I give my clients, is full video analysis of a setup before, during, and after the trade.

This video is a full explanation of the trade as it is happening. This is not in hindsight, it's what I think will happen with the market and how the trade will play out.

Notice in the video that I'm expecting a bounce, but I know that if a bounce doesn't come soon then we'll see the bottom fall out.

Adjusting the Trade To Cut Risk And Get Aggressive

4 Days later, the S&P 500 dropped from 2500 to about 2350.

And the volatility markets finally cleared 25, running another 10 percentage points up to 35.

What did this do to the trade?

The SPY calls lost a lot of their value, and the VXX calls ended up doing great.

So far, it was a breakeven trade.

My expectation now was for a very aggressive oversold bounce. In aggressive selloffs, the relief rally tends to mirror the energy in the selloff.

The bigger the selloff, the bigger the bounce.

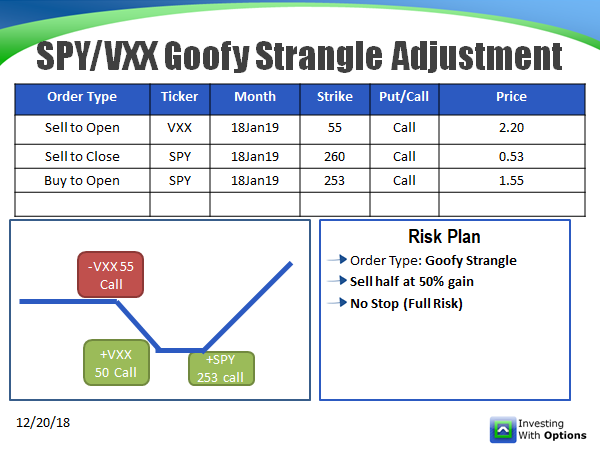

With that in mind, I made the call to do two things:

- Convert the VXX Call into a VXX Call Spread

- Roll the SPY Calls Down

By selling a VXX call, I could use the credit from that to pay for the cost of the roll:

Here was the full video explaining the trade setup:

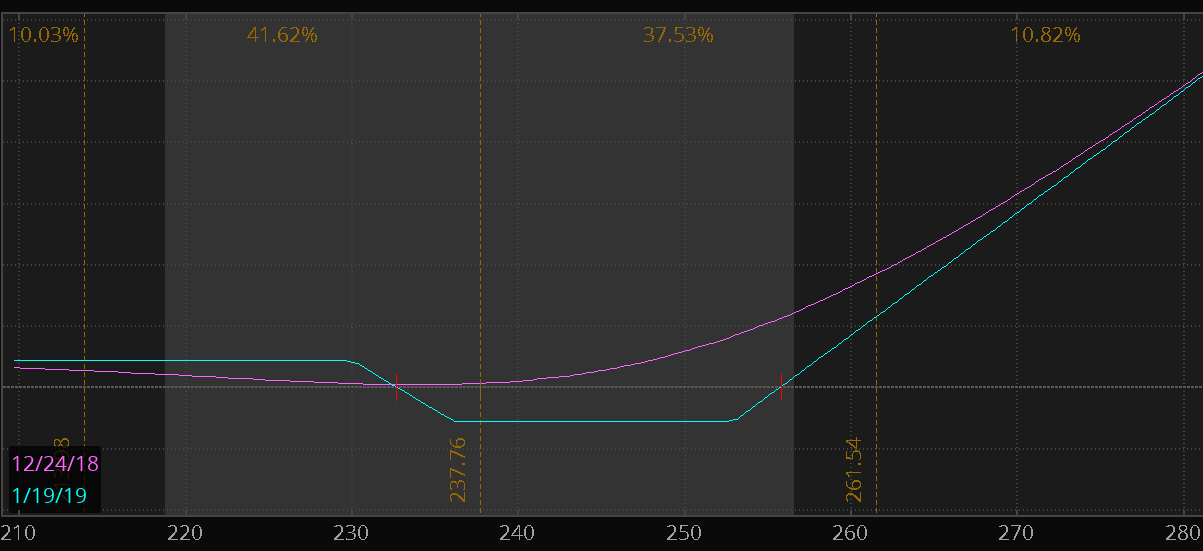

How the Trade Gets Into A Sweet Spot

This is where the setup really shines.

When the market is volatile, something happens in the VIX futures market. The near term VIX future has a higher value than the next term.

What this means is that the VXX will tend to trend higher, even if the market bounces.

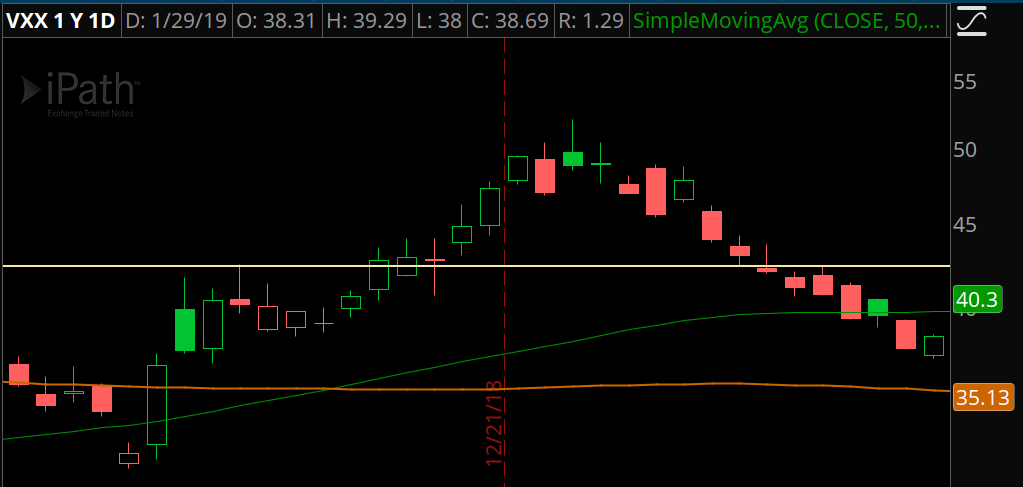

3 Days later, the market had bounced from 2350 back up to 2500.

And the VXX stayed near its peak. On December 24th, it traded at 49.45 and on the 29th it traded at 48.82.

By being long both SPY and VXX, you end up with this trade that hits a sweet spot.

In a vanilla strangle, into a bounce, you'll make money on the call and lose money on the put.

In this case, the trade made money on the VXX and the SPY legs.

Closing It Out

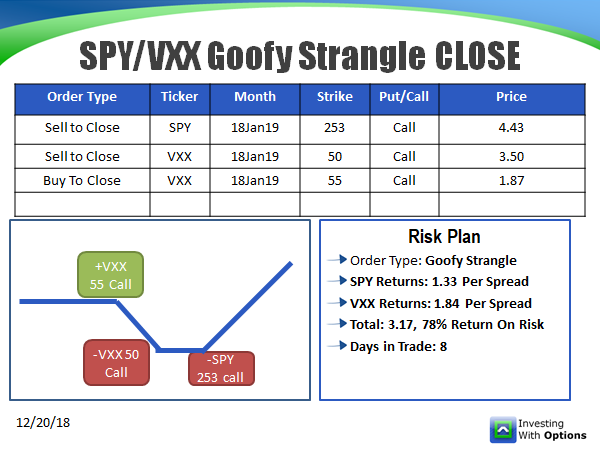

After 8 days, the trade was closed out for a return of 78% return on risk.

The SPY 253 had a cost basis of 3.07 when you include the cost of the roll, and the closing value was 4.43.

The VXX 50 call had a basis of 1.99 and was closed out for 3.50.

And the short VXX 55 call had a cost of 2.20 and was able to close out for 1.87.

All three parts of the trade were profitable.

If you had put on 10 spreads on at a cost basis of $4,040, you would have earned potentially $3,200 with very little adverse risk during the lifecycle of the trade.

Turning This Into A Trade System

I wanted to put this all out on a case study, not just to show you how a little creativity can get you fantastic rewards relative to your risk.

I also wanted to write it out to see if it can be systematized.

It's one thing to put on a great trade, it's another thing to make it repeatable.

The setup needs to have two parts:

- Statistically oversold market

- Spot VIX and VIX futures haven't made new higher highs

The entry is this:

- Long 30 delta call in VXX

- Long 30 delta call in SPY

Risk is then managed by converting either side to spreads and then rolling the losing side down. If this happens quickly, risk should already be cut down.

Get More Setups Like This

At IncomeLab, most of our trade setups are simpler than the case study just provided.

Iron Condors, Verticals, Calendars, Put Sales.

Every once in a while, unique circumstances in the market allow us to put on creative trades like this. Yes, it may be a bit complicated but that's where the edge is because nobody wants to figure it out.

Yet if you are an options trader looking for that distinct edge... and you want to learn while you earn... then IncomeLab is an amazing service for you.

Every single trade setup comes with a video fully fleshing out the risk and reward in the trade setup.

When you understand a trade and know how to manage the risk, then you'll be comfortable and confident putting on trades that will help you enhance returns, reduce risk, and print money.

The best way to get started is our $1 Trial. You'll get full 30 days access to IncomeLab with all trade alerts and direct chat access to the Head Trader.

(That's me. I'm the Head Trader. The chat access is a direct line in case you have any questions about a trade.)

Start Your $1 Trial To IncomeLab Today.