When a new technology comes along, it can sometimes be hard to explain it. Google uses a “web spider.” Amazon has a “cloud.” And twitter… well, twitter is twitter. The best product analogy I can think of for twitter is cigarettes. We hate that we use ’em. We know it’s toxic. Yet every 15 minutes, […]

Blog

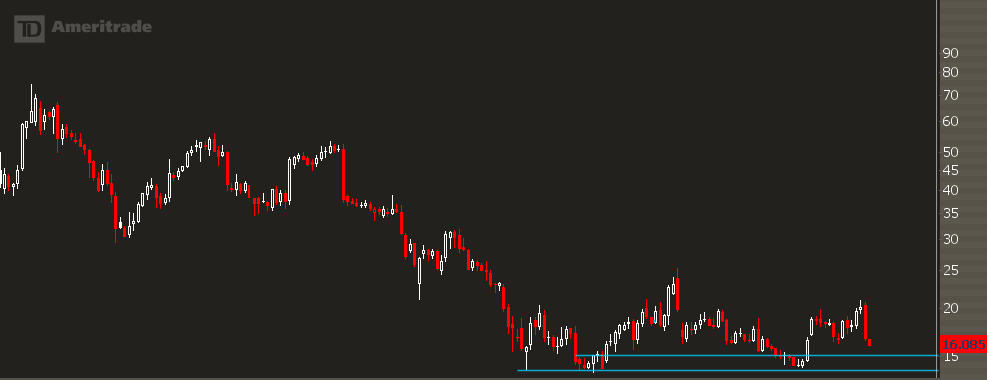

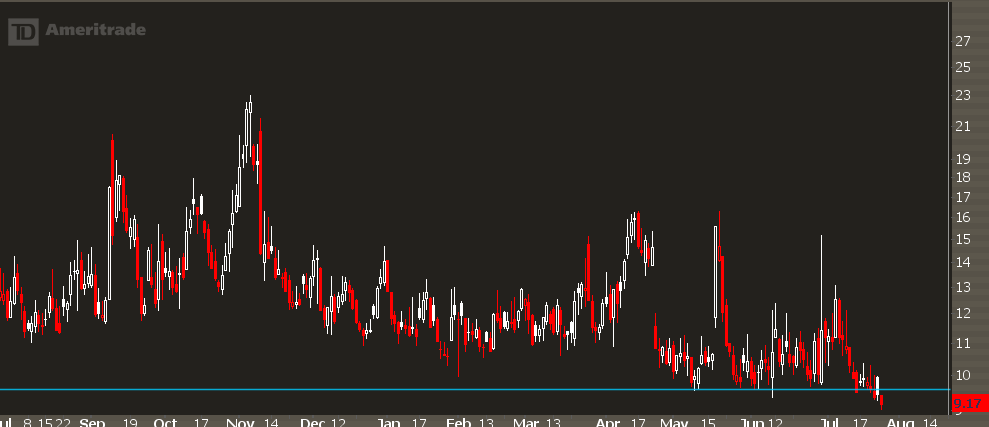

The Broken Volatility Markets

I’ve been avoiding this for a long time. I didn’t want to touch this topic. Why? First, I didn’t want to seem like some Chicken Little who was claiming the sky was falling and that there is structural risk to the markets. Second, I thought I’d be early. I’ve been thinking about this since the […]

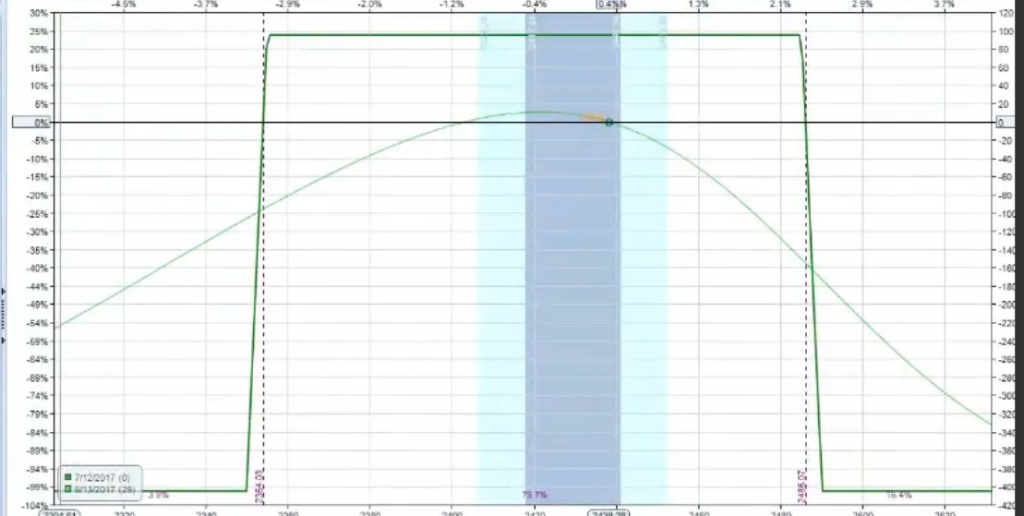

The Costly Iron Condor Trading Mistake You Must Avoid

It sounds sexy, doesn’t it? Put on a weekly iron condor trade… one per week, then let it expire and send the cash straight to the bank. Yet from many clients I’ve worked with, they’ve been burned on this exact trade… What’s going on? Why does it seem like such a “layup” trade until you […]

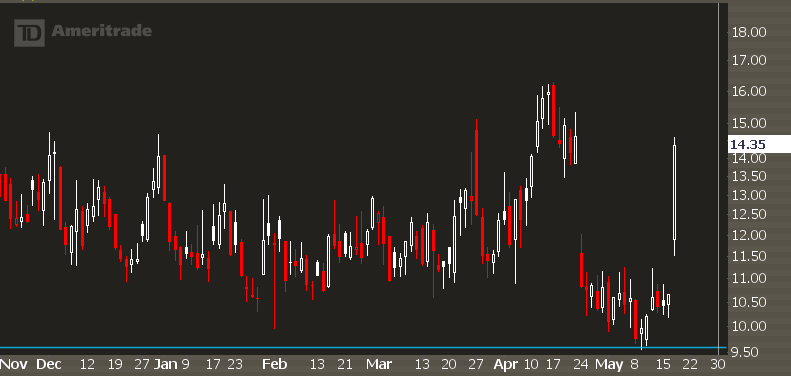

Nailing the Top in Mastercard (MA)

Trying to short a stock that’s in an uptrend can seem like a dangerous idea. Yet, if you choose the right option strategy and are very selective about where you put on risk, there are always a few setups that give you profitable opportunities. Let’s step through a recent example in Mastercard (MA) so you […]

You’ll Never Make Big Money Trading Unless You Understand This

I’m currently staring at my charts and it’s green across the board. The Nasdaq, Dow Jones, and S&P 500 are all hitting all time highs. Smallcaps look like they’re about to play catch-up. Momentum is clearly to the upside, and it doesn’t look like it’s slowing down any time soon. Any kind of correction is […]

Ignore The Political Idiots to Avoid Costly Losses

Today we’ve seen an obscene amount of hypersensitivity to a small selloff. At the time of this post, the S&P 500 is off about 1.5%. A pretty good move, but not unprecedented. Personally, I’ve felt that it’s been a long time coming. But the reasons being floated out for this selloff have been absurd. You’re […]