And it doesn't have to be.

The fourth quarter of 2018 now seems like a lifetime ago. Markets were crashing and there was no liquidity to be seen.

A few months later, the S&P 500 is within spitting distance of all time highs, and a new group of companies have taken the lead on pushing the market higher.

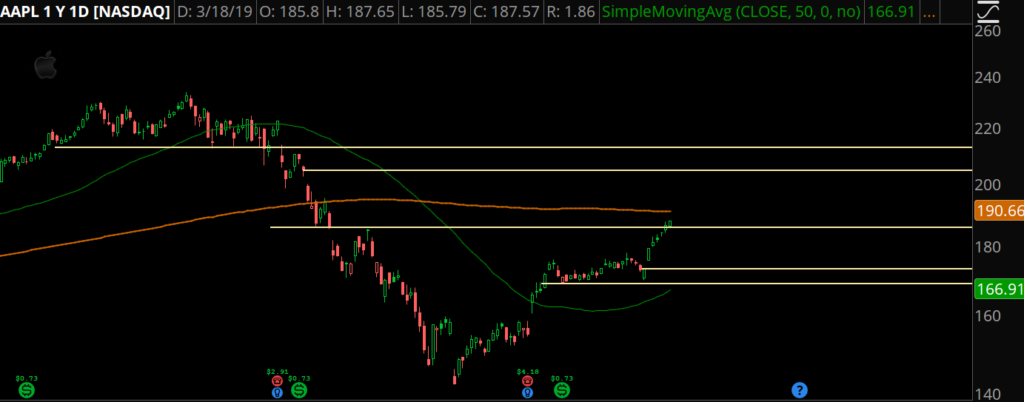

Meanwhile, AAPL is still down about 20% from its highs.

The end of 2018 was ugly for the stock. EVERYONE bailed.

It's not a market leader anymore... it can always re-emerge, but right now it's a good bet to start anticipating a new range developing in the stock.

This isn't some kind of perma-bearish "the stock is doomed" call.

This is based off of how I've seen AAPL trade over the past decade.

It will have moments of brilliance, take a big hit, then settle into a range for a while.

Since the stock's parabolic peak in 2012, there have been two separate MULTI-YEAR trading ranges.

It's not unreasonable to expect that here as well. The stock nearly got cut in half, odds are it's going to start going sideways for a while.

I like playing reversion here.

Iron condors or double calendars for market neutral trades, and selling vertical spreads when it starts to run hot in either direction.