And it doesn’t have to be. The fourth quarter of 2018 now seems like a lifetime ago. Markets were crashing and there was no liquidity to be seen. A few months later, the S&P 500 is within spitting distance of all time highs, and a new group of companies have taken the lead on pushing […]

Blog

Don’t Panic — Look At This Strategy Instead

The market might actually close down 1% today. Which is normal. I mean statistically. The market takes a hit like this all the time. Don’t panic. A pullback is needed. This is an opportunity. From the lows last December, the market rallied nearly 20% without any kind of reversion. This was the strongest rally in […]

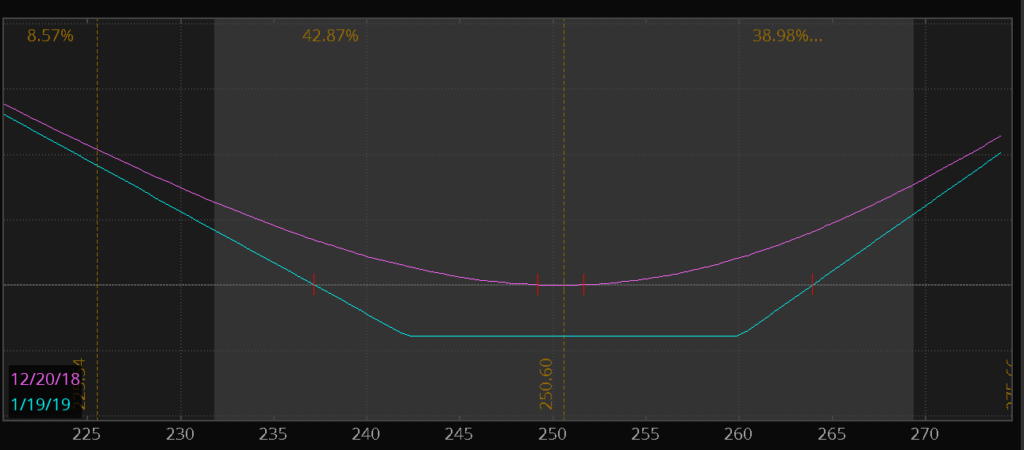

Case Study – A Market Crash Trade With SPY and VXX

This case study will show you a unique trade setup that returned 78% in 8 days, with almost no drawdown at all. I’m sharing this with you to show how sometimes… many times… you can get amazing trade setups when you combine two trades on the stock market and volatility market. In this case study, […]

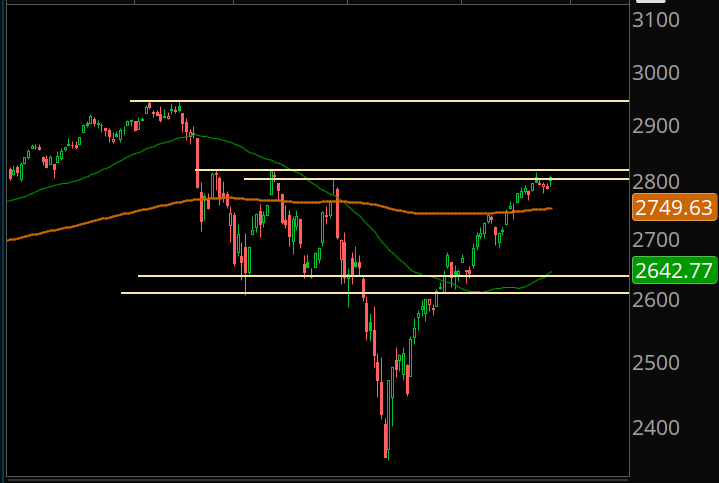

This Is What Happens When Everyone Is Obsessing Over The Same Levels

The S&P 500 has jammed up into 2800, which is the major resistance level from this past quarter. Everyone, and I mean EVERYONE is focused on it. If this were a textbook, sellers would show up and the market would take out 2750 in short order. But this isn’t a textbook. It gets messier than […]

Correction Hangover – When Will We Bottom?

Looking For A Breakout in Disney

I’m going through my relative strength screener after this big market pullback, and one name continues to stick out… Disney. It’s back near its all time highs while the rest of the market looks like garbage. And while the stock underperformed the markets for a few years, it looks ready to pop. This video explains […]