In the middle of a market collapse, it’s hard to find any themes to work with. They are selling everything that isn’t nailed down. When markets are crashing, correlations are running to 1 so it doesn’t matter how good of a stock picker you are. Yet one theme keeps sticking out in this entire mess, […]

Blog

How the Market Will Bottom

Knowing the exact price level that stocks will turn is unknowable. (It sure is fun to try, though.) We may not be able to predict the size of the selloff, but we can predict its shape. A Quick Primer Technical Analysis Has Two Parts First, you have supply and demand of an asset. Are there […]

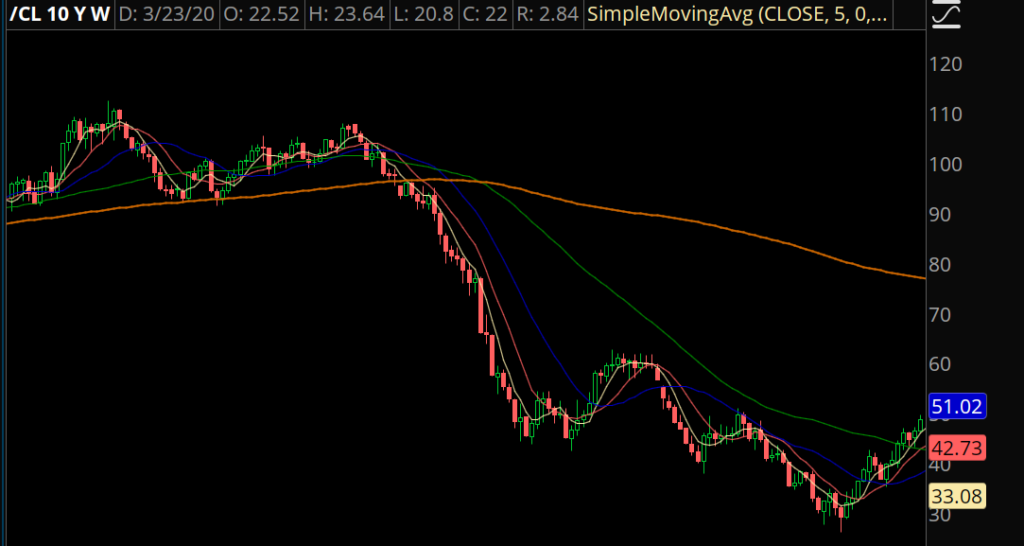

Oil Spills And Pandemics

This was the live feed that was slapped on our TV every night. The first part of the tragedy — where men died in a fire — was now just a memory. We couldn’t figure how much oil was gushing out from the pipe, but when it was all over about 200 million gallons went […]

I’m Calling A Top in Tesla.

Okay. Here we go. Stepping in front of this freight train. I’m probably early. At the time of writing this, TSLA is trading at 750. The previous trading day it was 100 points lower. And the way it’s going, the stock will tag 900 by the end of the week. But still… there’s some metrics […]

Use This Indicator For More Profitable Option Trading

A few years ago, I created a trading indicator to help me get an edge. In options trading there are other parts to a trade besides being bullish or bearish on a stock. You’ve gotta choose the right option strikes, duration, and strategy to make sure you get the best risk/reward on your trades. The […]

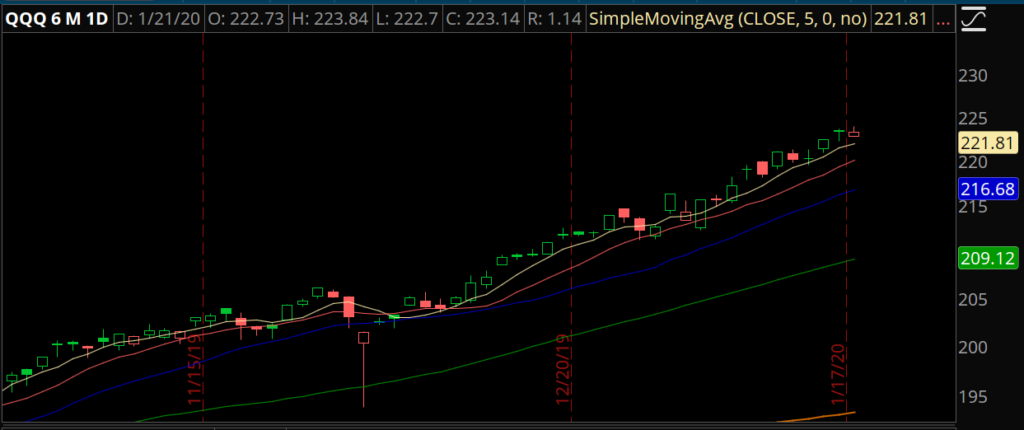

The One Thing That Can Take This Market Down

What a grind higher. The QQQ (Nasdaq 100 ETF) has rallied about 5% since the beginning of the year. A slow, steady march higher as entirely too many people got stuck leaning the wrong way as the market broke out to new all time highs. And what have we seen to start 2020? Political risk. […]